Shareholders

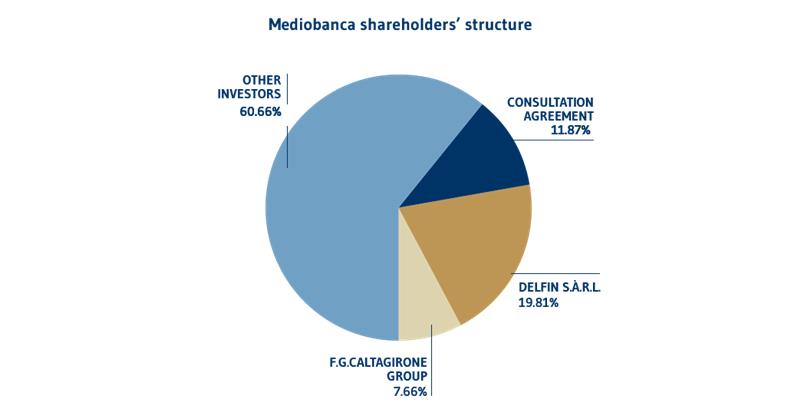

Mediobanca’s ownership structure consists of more than 46,000 shareholders, with a sizeable and increasing share of institutional investors.

The Mediobanca Group’s ownership structure has changed significantly since 2003, in line with the transformation of its business model from that of holding company to a specialist financial group. The percentage of institutional investors has grown, as the role of the historical Mediobanca shareholders’ agreement has diminished.

A Consultation Agreement with no lock-up conditions was signed by various shareholders at year-end 2018.

Updated as to 28 October 2024 based on the data recorded in the shareholders’ register, disclosures received pursuant to Article 120 of the Italian Finance Act, and other information available.

| SHAREHOLDER | % SHARE CAPITAL |

|---|---|

| DELFIN S.à r.l.. | 19.81% |

| GRUPPO F.G. CALTAGIRONE | 7.66% |

| GRUPPO BLACKROCK (1) | 4.23% |

| GRUPPO MEDIOLANUM | 3.49% |

(1) BlackRock Inc. (NY) through fifteen asset management subsidiaries (form 120 B of 6 August 2020), of which 0.69% pontential holding and 0.13% other long positions with cash settlement.

The shares are registered, and each share entitles its owner to one vote at the Annual General Meeting. For information on the number of shares following the most recent changes to the share capital, go to: Corporate data.

Board S-D Engagement with investors and proxy advisors

We assign considerable importance to good S-D engagement between the Board of Directors and institutional investors and other market operators. We believe that such engagement can improve transparency of disclosure, enhance mutual understanding, and, more generally, improve the quality of corporate governance, among other things for the pursuit of sustainable success.

The engagement policy adopted by the Board of Directors defines, within the limits set by law, the means by which investors and proxy advisors may Mediobanca with requests for S-D engagement, the subjects on which the Group is willing to engage, and the process by which such requests are managed.