Innovation for clients

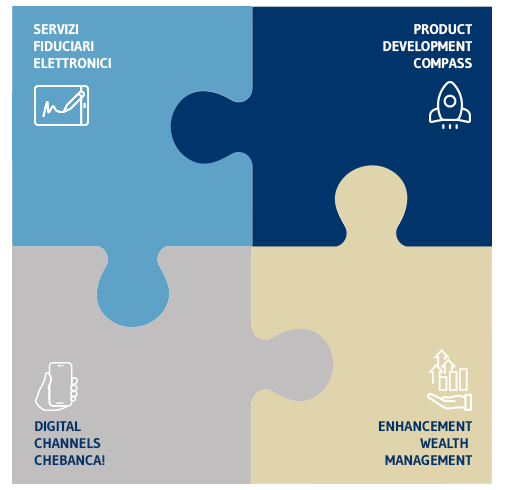

It is vital for banks to provide a quality experience for their clients, to enable business to grow and to strengthen relationships with customers. We at Mediobanca consider our customers’ user experience to be an issue of the utmost importance. Our intention is to continue to invest substantially in the development and enhancement of our digital channels in order to provide our clients with a more sophisticated customer journey, which will allow us to consolidate our client base, increase the number of potential clients, and add to the services offered.

The increased investment in digital platforms will enable us to provide an increasing number of remote services, translating to a superior quality offering in full security.

We have been pioneers in the use of electronic fiduciary services, which include the creation, verification and validation of electronic signatures, digital identities, and all other aspects governed by the eIDAS Regulation since 2016.

In 2013 Compass Banca was the first Italian financial institution to issue remote advanced electronic signatures. In this it was followed by Mediobanca Premier, Mediobanca and all the other Group Legal Entities, which today have all the necessary electronic signatures processes and technologies in place to enable dematerialized contracts to be used and operations to be carried out remotely, or in person at the branch offices, with user experiences tailored to the target customer, products and services offered, and formal requirements set by the regulations.

Operations have been designed specifically for each Group Legal Entity, using leading high-quality fiduciary services providers. Today, very high business volumes are managed with clients having the benefits that derive from the use of digital and advanced electronic (remote or graphometric) signatures.

The Group’s electronic signature platform has been operative since 2022. This project is gradually introducing electronic signatures not only to internal processes, procurement and contracts signed by employees, but also the complex contracts typically used by the Corporate & Investment Banking Division, with the correct applications for dees signed in Italian, EU and non-EU jurisdictions.

Interaction with digital identities with Mediobanca Premier and Compass Banca clients is also now operative. In particular, onboarding processes are carried out using digital identities, namely SPID, and research is being carried out regarding the use of Self Sovereign Identity applications (the decentralized digital identity model based on blockchain technology) and of the new Single European Digital ID Wallet, which is expected to be introduced with the new eIDAS 2 regulation.

Compass Banca has done major work to its systems and renewed its products, in order to develop a more complete and advanced product offering for its clients. It is investing in digitalization to offer its clients fully digital personal loans, developing instant loans through the use of innovative algorithms, and entering new market segments such as Buy Now Pay Later (BNPL).

The “time to yes” marketing lever is an asset in which Compass continues to invest in order to develop its online personal loans, with the objective of making the customer experience quicker and more fluid. “Nano” loans, granted in real time, have been introduced, with credit risk assessments processed using only “resident” data on the customer’s smartphone. The service has been developed in partnership with start-up company Redo.

In the BNPL market, Compass has launched its Pagolight product – which has subsequently been renamed as HeyLight – constructing a unique, scalable model to accelerate coverage of the market, both online and in-store. The introduction of this product has enabled the company to obtain a leading position in the market, helped by the strategic acquisition of fintech start-ups Soisy and HeidiPay in the Swiss market.

We are also working hard to bring digital innovation and development to the Wealth Management sector addressed by Mediobanca Premier and by Mediobanca Private Banking.

Mediobanca Premier has developed a highly innovative mobile app offering customers an outstanding user experience. The app addresses customers’ new needs by adapting the services offered through “do it yourself” functions for investment management, expanding the range of services to support online trading, and a dedicated channel for clients to interact remotely with their advisor through video calls. The advanced trading functions now allow clients to trade independently, monitoring global market trends themselves, and entering automatic buy and sell orders based on specific price variations. The application has been improved in terms of usability, to facilitate more intuitive browsing, with rapid authorizations granted through the use of biometric data, which has significant advantages in terms of speeding up the process and in terms of security.

To support the Mediobanca Private Banking division’s bankers, the digital Wealth Management and Private Banking services have been redesigned and strengthened, through the launch of a new scalable and streamlined platform (ADV360) developed in conjunction with the Armundia group. With its cutting-edge technology architecture, ADV360 supports advanced financial advisory services, enabling bankers to come alongside clients at all stages of the service, with bespoke proposals and management in real time.

For the client, digitalized services mean increased efficiency and a wider range of advisory services offered, in full transparency in their relation with the Bank, and with the possibility of engaging with their own banker from a multi-channel and multi-device perspective.