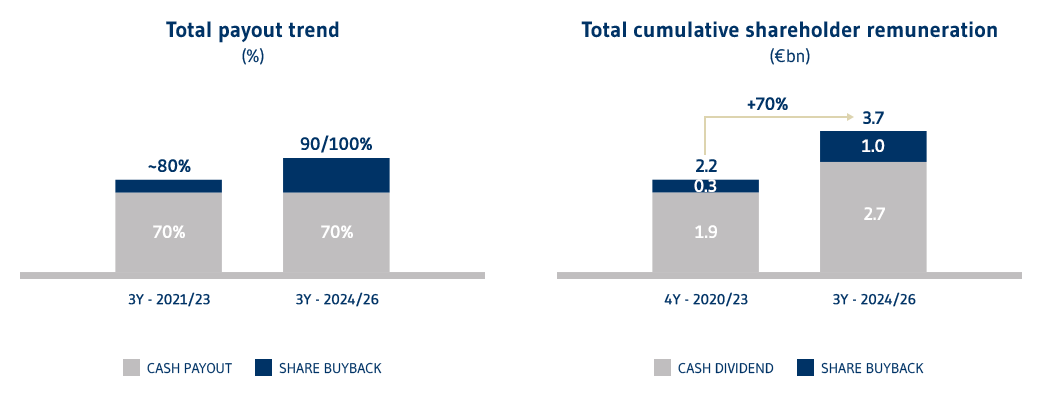

Shareholder remuneration

OUR STRATEGIC PLAN PROVIDES FOR SIGNIFICANT GROWTH IN SHAREHOLDER REMUNERATION THROUGH BOTH DIVIDENDS AND SHARE BUYBACK SCHEMES

The Group will significantly increase the remuneration it pays to its shareholders over the time horizon covered by the Strategic Plan, distributing a cumulative total of up to €3.7bn over the three years (FY 2024, 2025 and 2026), some 70% higher than the amount distributed in the previous four years (FY 2020, 2021, 2022 and 2023).

The remuneration paid to shareholders will be made up of:

- €2.7bn in dividends, 40% higher than the €1.9bn distributed in the previous four years, with an annual cash payout of 70%;

- €1bn in share buybacks and cancellations.

The increased distribution derives from the Group’s enhanced earnings generation capacity and from the implementation of an asset growth policy focused on capital-light businesses.

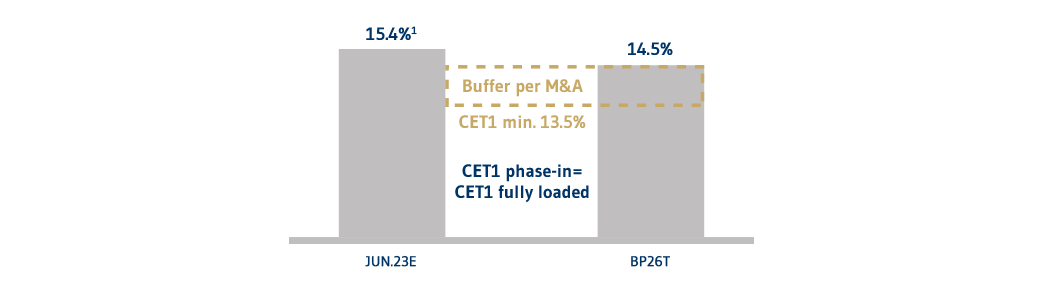

This distribution policy will enable a CET1 ratio of above 14.5% to be maintained over the Strategic Plan horizon, which is sufficient to:

- Maintain one of the best ratings in the domestic market;

- Consolidate Mediobanca as one of the best-capitalized European banks, a differentiating factor in WM and CIB business;

- Maintain an approx. 100 bps buffer for possible M&A opportunities to develop the Group’s business, based on a minimum CET1 FL level of 13.5%.

1) CET123 FL 15.4% including: ~100bps of permanent benefit from Danish Compromise, Arma acquisition, Revalea disposal

Subject to annual authorization by the ECB and approval by shareholders gathered in Annual General Meeting, we anticipate that:

- Total dividends of €2.7bn will be paid in 3Y, with a cash payout ratio of 70%. Payment of an interim dividend has been introduced since May 2024, with part of the payment brought forward to May (equal to 70% of the profits generated in the July-December period), and the balance is paid in November (equal to 70% of the profits generated in the January-June period);

- A new share buyback and cancellation scheme for a total of €1bn to be implemented across the Strategic Plan time horizon, starting in October 2023, with the quantity to be decided annually based on organic growth. Approx. 80% of the shares acquired will be cancelled.

This distribution policy, which is subject to ECB monitoring and/or authorization, will be revised if the CET1 FL ratio falls below 13.5%.