Management and Board pay

In line with international best practices, our remuneration policies for senior management adequately balance base salaries with performance-based pay to prevent risks and avoid an approach focused on short-term results

| FIXED COMPENSATION | VARIABLE COMPENSATION | |||||

| EMPLOYEE CATEGORY | BASE (Upfront) | PENSION PLAN CONTRIBUTION | SHORT TERM INCENTIVE (Annual scorecard) | LONG TERM INCENTIVE (Strategic Plan 23 -26) | ||

| 5Y deferral - 60% deferred* | 5Y deferral - 60% deferred* | |||||

| CASH | CASH | CASH | SHARES | CASH | SHARES | |

| Non Executive Directors included Chairman | 100% | |||||

| Executive Directors | 100% | 100% | 47% | 53% | 100% | |

| Executives Senior Management | 100% | 100% | 47% | 53% | 100% | |

| Upfront | 4 Y Deferral - 40/60% deferred* | 4 Y Deferral - 60% deferred | ||||

| Other Executives (Material Risk Takers) | 100% | 100% | 50% | 50% | 100% | |

* If variable amount equal or higher than € 424,000 for 2024 and higher than € 436,000 in 2025

Chairman’s remuneration

The Chairman of the Board receives fixed remuneration only.

The general meeting establishes fixed fees for the non-executive Directors without any incentives linked to the bank’s performance. They also receive third-party liability insurance coverage.

| DIRECTORS’ COMPENSATION, FY 2023-26 | |

|---|---|

| Compensation approved by shareholders in AGM | 2,500,000 |

| No. of members | 15 |

| Board of Directors Compensation payable to each Director Additional compensation payable to Deputy Chair |

1,570,000 100,000 35,000 |

| Executive Committee (2 members) Compensation payable to each member |

160,000 80,000 |

| Appointments Committee (5 members) Compensation payable to each member Additional compensation payable to Committee chairperson |

135,000 25,000 10,000 |

| Risks Committee (5 members) Compensation payable to each member Additional compensation payable to Committee chairperson |

370,000 70,000 20,000 |

| Remuneration Committee (5 members) Compensation payable to each member Additional compensation payable to Committee chairperson |

185,000 35,000 10,000 |

| Related Parties Committee (4 members) Compensation per member Additional compensation for Committee Chair Sustainability Committee (5 members + 1 executive Di | 70,000 15,000 10,000 |

| Sustainability Committee (5 members + 1 executive Director) Compensation per member |

125,000 25,000 |

| Compensation for Lead Independent Director | 20,000 |

The remuneration of the Mediobanca CEO and the Group General Manager is regulated by individual agreements approved by the Board of Directors, and comprises:

- Fixed salary of €1,800,000 for the Chief Executive Officer and of €1,500,000 for the Group General Manager. The fixed salaries of both has remained unchanged since 1 July 2011;

A variable annual component (short-term incentive) which only accrues if the gateways stipulated in this Policy (see the section entitled “Gateways and risk-performance correlation”), commensurate with the quantitative/financial and qualitative/non-financial performance indicators contained in an individual scorecard approved annually by the Board of Directors at the Remunerations Committee’s proposal being met. Based on the 2:1 cap and taken in conjunction with the Long-Term Incentive Plan described under point 3) below, the annual short-term variable component can be as much as 1x the fixed remuneration, i.e. no more than 50% of the maximum potential variable remuneration payable on an annual basis. The scorecards include financial and non-financial performance objectives for their respective areas of responsibility, bearing in mind that the combination of KPIs used for senior roles in any case requires objectives to be met at the Banking Group level, based among other things on a prudential approach. The financial objectives may, for example, regard: risk-adjusted profitability; risk indicators; revenues, at Group level or for specific Divisions and/or areas of responsibility; other objectives consistent with the guidelines of the Strategic Plan with regard to capitalization, liquidity or new business initiatives. Each objective is weighted according to the relevance assigned to it by the Board of Directors and the actual margin of autonomy in terms of decision-making. The objectives are chosen on the basis of the KPI Bluebook. Non-financial ESG and CSR objectives, including in the form of projects, are also an integral part of the 62 scorecard, linked to the role of the CEO and Group General Manager as “enablers” of Environmental, Social and Governance initiatives to support value creation for society (e.g. in the areas of human capital, social responsibility, and innovative content).

All the objectives included in the scorecard are appropriately weighted to guarantee an overall weighting of 100%, as follows:

- 85% of the overall weighting refers to financial KPIs, with 10% reserved on a fixed basis for financial ESG objectives;

- 15% refers to non-financial qualitative indicators, which are pre-established and expressed in the evaluation drivers.

The incentivization curve is structured so that the overall objectives being met triggers the payment of a variable component, which is structured as follows: 85% of the fixed annual salary if the financial and non-financial targets are met, and 100% in the event of outperformance in both:

- When the financial targets, which represent 85% of the total KPIs, are met and exceeded, the amount of the bonus payable to the Mediobanca CEO and the Group General Manager is comprised in a range between 75% (when the target, which is usually set on the basis of the budget and/or in accordance with the annual sub-division of the Strategic Plan targets) and 85% (in the event of out-performance and/or especially outstanding results, determined specifically on the basis of the individual type of objective involved) of their annual gross fixed salary for the respective weighting. An amount equal to between 50% and 75% of their annual gross salary accrues if at least 85% of the target is achieved. The measurement is performed by means of linear interpolation.

- The qualitative KPIs section with their respective weightings, up to a total of 15% of all the KPIs, is included in the scorecard’s functioning and assessed via specific pre-established drivers (also linked to earnings indicators where appropriate), and finalized using an evaluation scale based on their achievement.

- The variable remuneration is determined on the results of each ofthe targets, each based on their own weighting.

- The cap on variable remuneration for the short-term component set at 100% of the fixed salary for purposes of consistency with the Long-Term Incentive Plan described in the following paragraph applies in any case.

The time horizon over which the variable remuneration is distributed, in cash and shares, is therefore six years for senior management and five years for the other Identified Staff.

An overview of the timing for the various distributions is shown in the table below:

| Anno T |

T+1 | T+2 | T+3 | T+4 | T+5 | ||

|---|---|---|---|---|---|---|---|

| Senior Management with variable remuneration >= € 436,000 |

20% Upfront cash |

20% Upfront equity |

13% Deferred cash |

11% Deferred equity |

11% Deferred equity |

11% Deferred equity 14% Deferred cash |

|

| Senior Management with variable remuneration < € 436,000 |

25% Upfront cash |

25% Upfront equity |

11% Deferred cash |

9% Deferred equity |

10% Deferred equity |

9% Deferred equity 11% Deferred cash |

|

| Other Identified Staff with variable remuneration >= € 436,000 |

20% Upfront cash |

20% Upfront equity |

15% Deferred equity 5% Deferred cash |

15% Deferred equity 5% Deferred cash |

20% Deferred cash |

||

| Other Identified Staff with variable remuneration < € 436,000 |

30% Upfront cash |

30% Upfront equity |

10% Deferred equity 5% Deferred cash |

10% Deferred equity 5% Deferred cash |

10% Deferred cash |

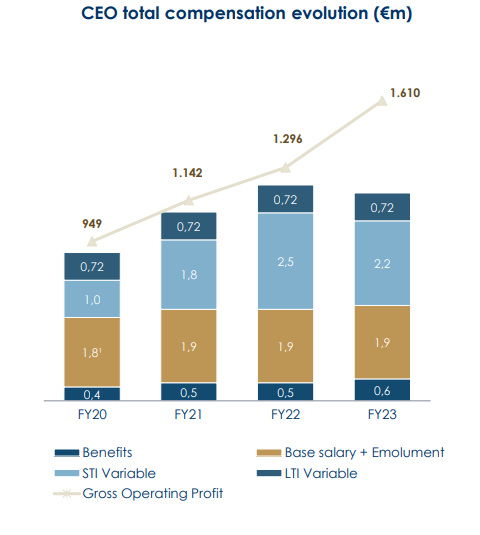

CEO compensation FY24

| FINANCIAL OBJECTIVES | TOTAL WEIGHTING 85% | KPI TARGET = 75% FIXED SALARY | Δ KPI OUT- PERFORMANCE =85% FIXED SALARY | |

|---|---|---|---|---|

| RORWA Banking Activity: Profit before Taxes (PBT) Group Banking Activities/Banking RWAs Optimization of return on RWAs allocated to banking activities |

25% | Vs. Budget/Plan | +11% target | |

| Gross Non-Performing Loans (NPL Ratio) Focus on asset quality |

15% | Vs. Budget/Plan | +5% target | |

| Total Revenues (€m) Focus on Group total revenues |

20% | Vs. Budget/Plan | +4% target | |

| Capital Generation (bps) Focus on growth in the Group’s capital position through profit generation |

15% | Vs. Budget/Plan | +2% target | |

| ESG objectives | 10% | Vs. Budget/Plan | ||

| a) Loans with ESG characteristics as percentage of total new loans in Corporate Banking (CIB) | +27% target | |||

| b) Incidence of ESG disbursement on new retail production (Consumer Finance – WM Premier) | +6% target | |||

| c) Percentage of SFDR Article 8/9 Funds and ETFs in Mediobanca Premier and Mediobanca Private Banking client portfolios | +3% target | |||

| NON-FINANCIAL/QUALITATIVE OBJECTIVES | TOTAL WEIGHTING 15% | KPI TARGET = 10% FIXED SALARY | Δ KPI OUT-PERFORMANCE = 15% FIXED SALARY | |

| Our People ESG objectives to support diversity and inclusion, develop skills and promote engagement. a) toDEI initiatives implemented b) Mediobanca Academy c) Employee engagement (YoY trend in participation) |

7,5% | Evaluation scale Not achieved Partially achieved Target archieved Fully achieved |

||

| Our Community ESG objectives to support value creation for society (linked to the Mediobanca Group’s CSR): a) Sustainability initiatives (no.) b) Third sector initiatives c) Support for social initiatives with Group staff volunteering (YoY trend in participation) |

7,5% | Evaluation scale Not achieved Partially achieved Target archieved Fully achieved |

||

| Total scorecard | 100% | KPI TARGET= 85% FIXED SALARY | Δ KPI OUT-PERFORMANCE = 100% FIXED SALARY | |

As required by article 78 of Consob resolution 11971 of 14 May 1999, as amended, section 2 of the 2022 remuneration policy lists, for 2021/2022 and naming each recipient, the amounts paid, the stock grants and other equity-based incentive plans benefiting the members of the management and control bodies, the general managers and, at aggregate level, other key managers. Anyone who, in the course of the year, held the aforesaid offices, even for a fraction of the year, is included. Furthermore, additional aggregate quantitative information has been published pursuant to the Bank of Italy’s supervisory requirements.