Innovation for clients

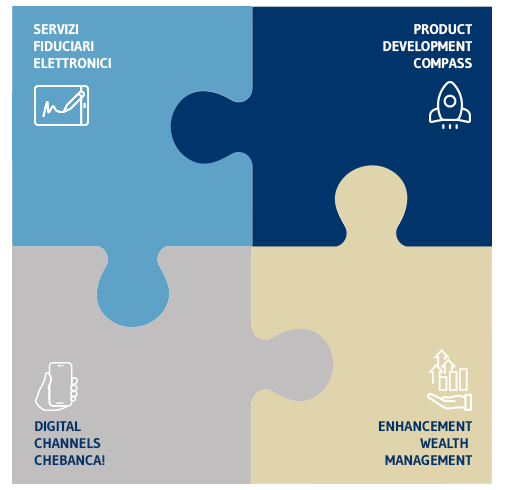

It is vital for banks to provide quality experience for their clients to enable business to grow and strengthen client relationships. For us at Mediobanca too, customer experience is an issue of huge importance. Our intention is to continue supporting substantial investments in the development and enhancement of digital channels in order to guarantee a sophisticated customer journey which will enable us to consolidate our client base, increase the number of potential clients, and add to the number of services offered.

Higher net investments in digital platforms will also enable us to provide an increasing number of remote services, which will translate to a superior quality offering in full security.

We have been forerunners in the use of electronic fiduciary services, which include the creation, verification and validation of electronic signatures, digital identities, and all other aspects governed by the eIDAS Regulation since 2016.

In 2013 Compass Banca was the first Italian financial institution to issue remote advanced electronic signatures, followed by Mediobanca Premier, Mediobanca and the other Group Legal Entities, all of which today have processes and technologies in place for electronic signatures that have enabled, among other things, the dematerialization of contracts and remote operations (as well as in-person at branch offices), with the user experience correctly tailored to the target client, the products and services offered, and requirements set by the regulations.

Operations have been designed specifically for each Group Legal Entity, using leading providers of high-quality fiduciary services which offer significant advantages for clients, in view of today’s very high business volumes, deriving from the use of digital and advanced, remote or graphometric electronic signatures.

The Group’s electronic signature platform has been operative since 2022. This project is gradually introducing electronic signatures not only to internal processes, procurement and contracts signed by internal staff, but also the complex contracts typically used by the Corporate and Investment Banking division, with the correct applications for deeds signed in Italian, EU and non-EU jurisdictions.

Interaction with digital identities for Mediobanca Premier and Compass Banca is also now operative, with onboarding via the Italian public digital identity system (SPID), and Self Sovereign Identity applications (the decentralized digital identity model based on blockchain technology) and opportunities to use the new Single European Digital ID Wallet, expected with the introduction of the eIDAS 2 Regulation, are being looked at.

For many years now the Mediobanca Group in its incarnations has been strongly focused on serving all different client types.

Compass Banca has done major work to its systems and made important changes to its products, in order to develop a more complete and advanced product offering for its clients. It is investing in digitalization to be able to provide fully digital personal loans, developing instant loans with the use of innovative algorithms, and entering new market segments, such as Buy Now Pay Later (BNPL).

Compass continues to invest in its “time to yes” as a marketing asset for developing online personal loans, in order to make the customer experience more fluid and quicker. So-called “nano loans” have been introduced, that are granted in real time, with credit risk assessments compiled using only “resident” data on the client’s smartphone. The service has been developed in partnership with start-up Redo.

Compass continues to grow in the BNPL market through the “Pagolight” product, with the construction of a unique, scalable model to accelerate coverage of the market, both online and in-store. The introduction of this product has enabled Compass to distinguish itself on the market, with a leading position, helped by the strategic acquisition of fintech start-ups Soisy and HeidiPay, both of which are specialized in BNPL operations.

At the same time, we have also been working to bring innovation and digital development to the Wealth Management segment served by Mediobanca Premier and the Mediobanca Private Banking division.

Mediobanca Premier! has developed a highly innovative mobile app which offers an outstanding user experience. The app addresses the new customer needs, through the adaptation of services featuring “do it yourself” functions for investment management, expanded services in support of online trading, and provision of a full channel for clients to interact remotely by video chat with their own advisor. The advanced trading functions now allow clients to trade independently, monitoring global market trends themselves, and entering automatic sell and buy orders based on specific price variations. The application has been improved in terms of usability, to facilitate more intuitive browsing, and adding rapid authorizations granted via biometric data, offering strong advantages in terms of speeding up the process and of higher security.

To support the Mediobanca Private Banking Division’s bankers, Wealth Management and Private Banking digital services have been redesigned and strengthened through the launch of a new scalable and agile platform (ADV360), developed in partnership with the Armundia Group. With its cutting-edge technology architecture, ADV360 supports advanced financial advisory services, meaning the client is accompanied at every stage of the service provided, with bespoke proposals and management in real time.

For the client, digitalized services translates to enhanced efficiency and a wider range of advisory services, provided in full transparency with the Bank, and offering the possibility to interact with their own banker from a multi-channel, multi-device perspective.