Results and presentations

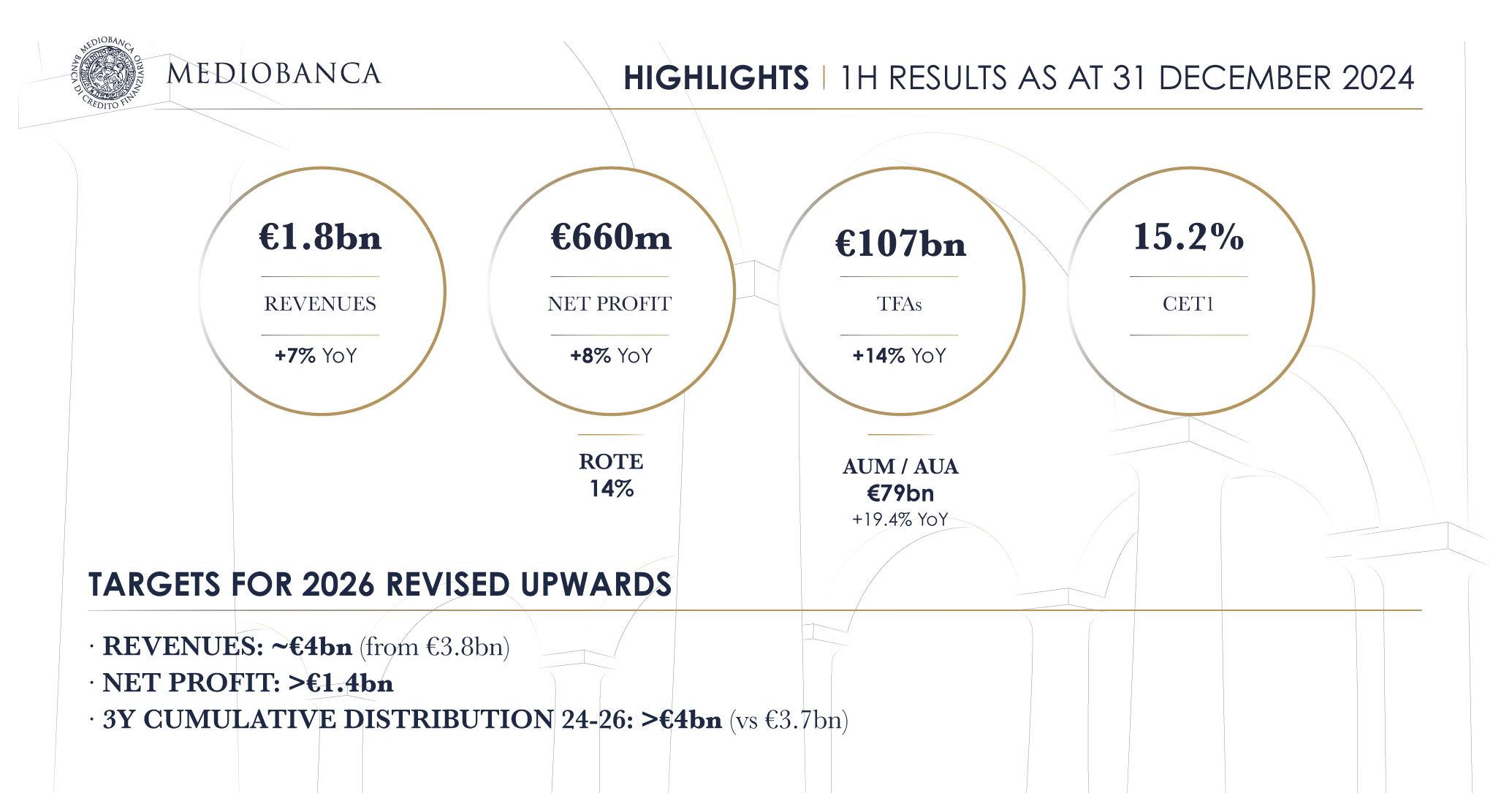

Alberto Nagel, CEO of Mediobanca, said: “After posting its best-ever set of results in the last financial year, in 1H FY 2024-25 Mediobanca has again reported growth in all its divisions, consolidating the main initiatives launched in the 2023-26 Strategic Plan. All physical and digital platforms have been enhanced, by attracting the best talents: the service offering has been expanded and repositioned increasingly to reflect the Private and Investment Banking model, which has been well received by clients in their investment, lending, and ordinary and extraordinary advisory decisions. The sustainable growth of our business is firmly underway and proceeding at a pace which is consistently faster than previously. Mediobanca is concentrating on execution of its “One brand-One culture” Strategic Plan”, which is positioning it as an operator increasingly focused on Wealth Management strongly integrated with synergic and diversified Corporate and Investment Banking. Shareholder remuneration and value creation see Mediobanca positioned at best sector levels, in a decreasing interest rate scenario”.