CIB role

For nearly 75 years we have been the top merchant bank in Italy and now we are a leader in Southern Europe as well, thanks to our excellent services, ability to interpret our customers’ needs and the reliability and discretion for which we have always been known

Corporate & Investment Banking was our starting point, the business in which we originally developed the unique qualities for which we are still known today. Since Mediobanca was founded in 1946, we have been helping Italian businesses growth with premier advisory services and a complete range of credit solutions, offering customized services and the most sophisticated solutions on financial markets, from advisory to lending, capital markets to specialty finance.

With our long-standing presence, solid market position, distinctive specialization, excellent service quality and professionals of the finest calibre, Mediobanca’s corporate customers know they can count on the excellence and exclusivity that have earned us an impeccable reputation over time.

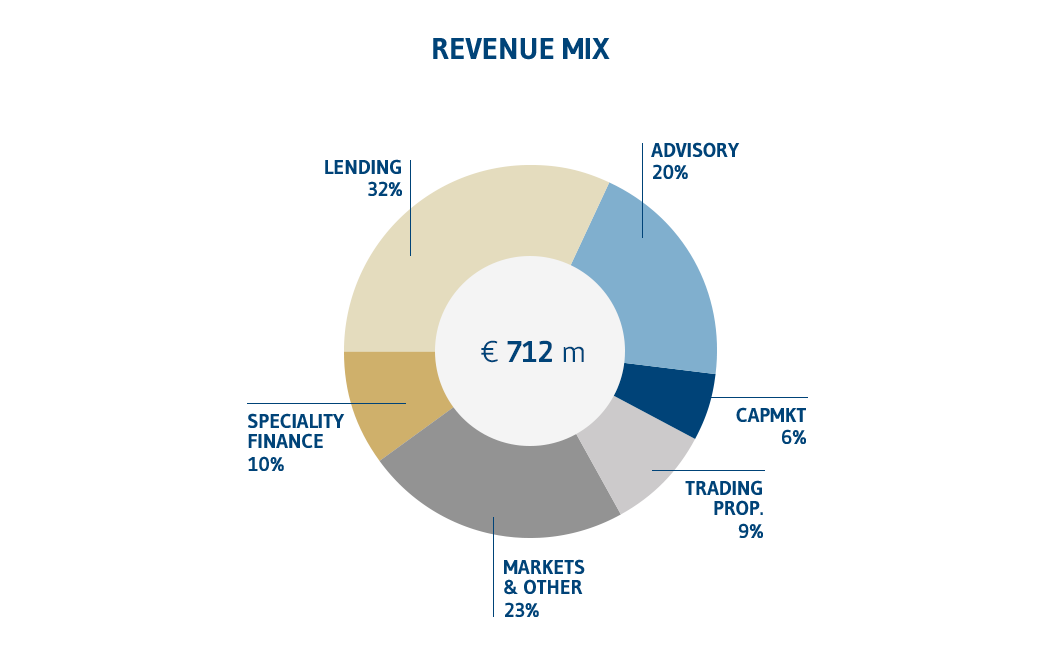

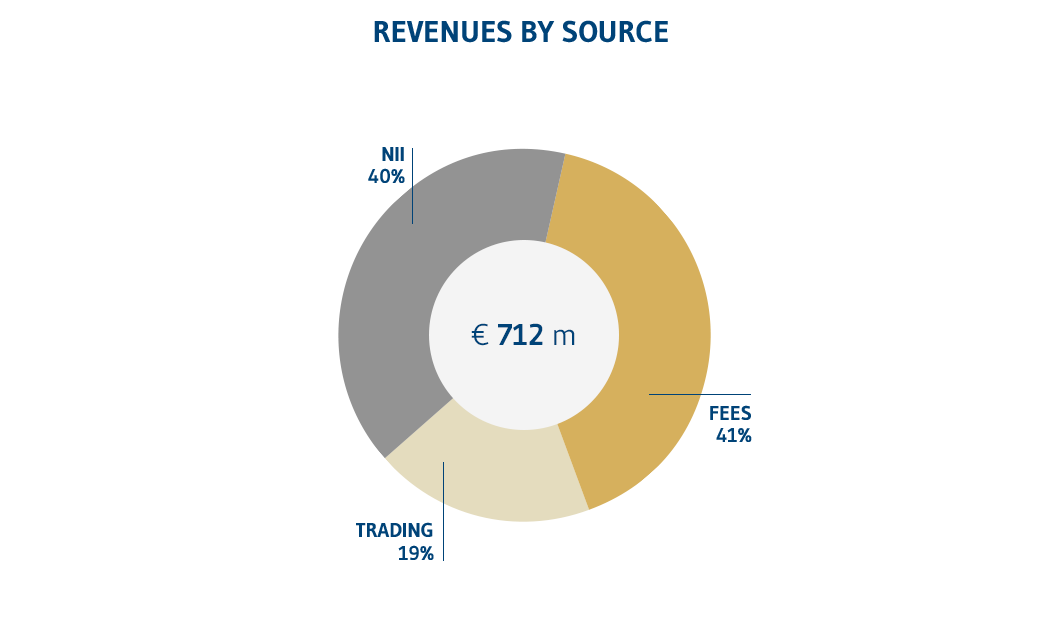

Investment banking will be the linchpin of the future Mediobanca group and play a crucial role in our diversification strategy. Our investment banking business has demonstrated resilience in all stages of the economic cycle thanks to a balanced mix of products.

In addition to our prominent position in Italy, we also have consolidated operations abroad, with branches and offices in Paris, New York, Madrid, London and Luxembourg. In the last years we have strengthened our presence in Europe and have gained an enviable position in France through the strategic partnership agreement signed in 2019 with the French boutique Messier & Associés. In 2023 Mediobanca signed a strategic agreement with Arma Partners, a London-based financial advisory firm leader in the Digital Economy. Arma Partners has approx. 80 bankers and an international client base.

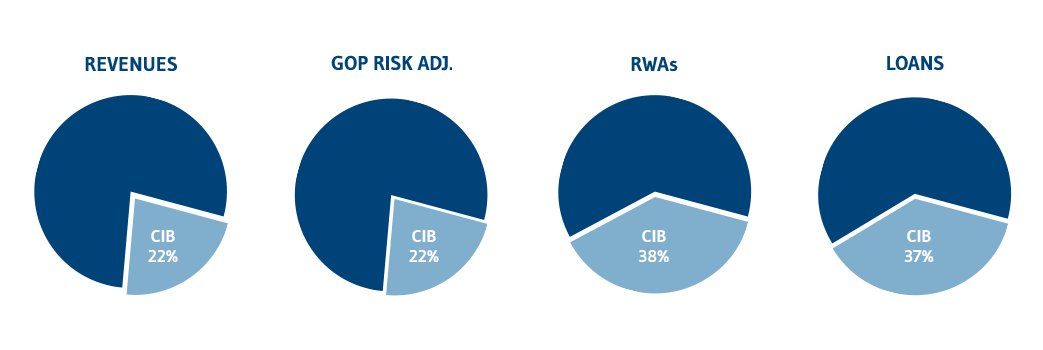

Highlights (annual consolidated results at 30 June 2024)

- Our work has always reflected our quality, reliability, discretion and restrain

- Our lean organization - boutique likewise - lends flexibility to decision-making processes

- CIB services revolve around the customer’s needs, which we interpret and anticipate with specific, tailor-made solutions

- With a cost/revenue ratio of ~50%, our structure is designed to reward discipline and efficiency

- Combined with a low risk appetite, our asset quality is among the best in Europe

- Trading is limited and negligible compared to other merchant banks

- The synergies between CIB and private banking are increasingly one of the greatest advantages of our offer, securing us a unique competitive edge in Italy

Despite the challenging market context in which our competitors have suffered widespread decline in revenue and undergone restructuring, our CIB division has skilfully preserved revenue, profitability and its low risk profile. Specialist approach, diversification of client-driven activities, focus on mid-large clients with high ratings are all key factors in determining the sustainability of the business in the current economic environment.

Highlights (annual consolidated results at 30 June 2024)

Revenues

€763 m

Net fee income

€361 m

Net income

€244 m

Loan book

€19.0 bn

RORWA

1.4%