The role of Consumer Finance

We have been pioneer in consumer credit in Italy and we are now an established leader in this growing market today. Our subsidiary Compass Banca stands apart for its solidity, profitability and the sustainability of its results over time

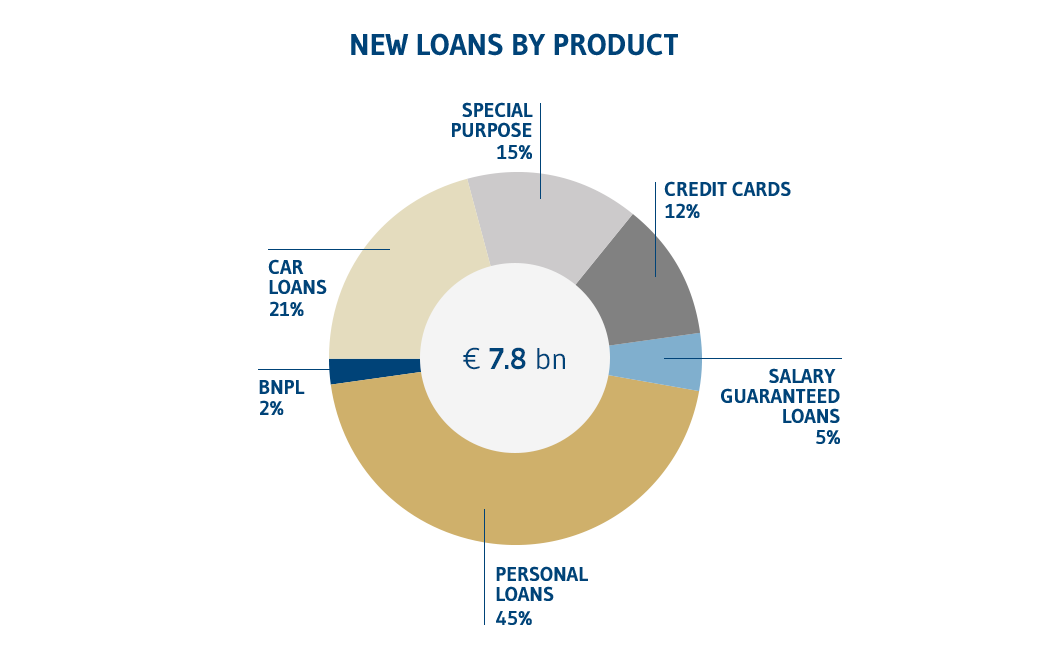

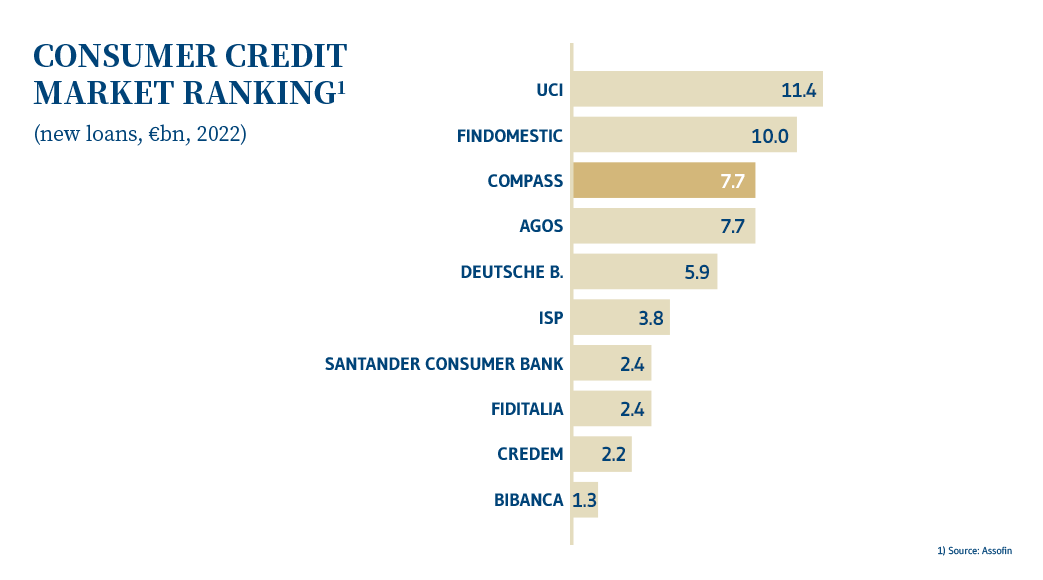

We have always worked alongside Italian families to meet their financial needs. Our group has been active in consumer credit for more than 70 years through Compass Banca. With a 14% (excluding credit cards) market share, it has been one of the top five consumer credit players in the Italian market for over a decade.

With an in-depth understanding of the market, gained through years of operating and gathering statistics, Compass Banca can identify, evaluate and best serve its customers. New available and widely used technologies have enabled Compass Banca to complete its offer with innovative products to benefit from new market growth trends.

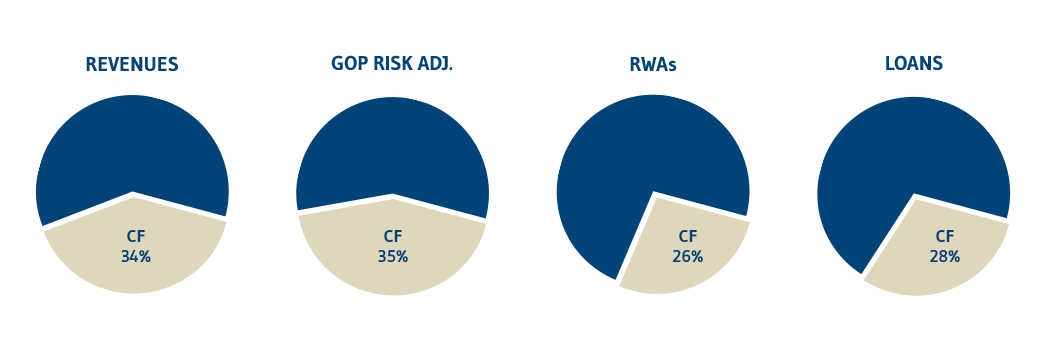

Consumer Finance is fundamental to the balance and diversification of our businesses. Its distinct anti-cyclical performance compared to the other divisions, which are more vulnerable to economic trends, has enabled Consumer Finance, as well as the Mediobanca group, to grow even in times of economic crisis. Thanks to Compass Banca’s record-breaking results, Consumer Finance is now our largest and most profitable division and the top contributor to the group’s revenue, interest income and profitability.

Highlights (annual consolidated results at 30 June 2024)

Compass combines solidity and reliability with a strong penchant and talent for innovation. The long-term ramifications of every strategic choice are assessed considering the sustainability of results over time, profitability and the creation of value for the Mediobanca group.

Compass is known for its:

- leadership (thard-largest market player with a share of roughly 14%,excluding credit cards);

- consolidated customer base;

- broad, diversified distribution platform that increasingly prioritizes direct distribution channels;

- management approach focused exclusively on value;

- high scoring and pricing capabilities;

- excellent asset quality (net non-performing loans account for 1.6% of loans at 30 June 2024) thanks to the complete coverage of non-performing loans within 12 months;

- effective recovery processes that actively contain the cost of risk.

Highlights (annual consolidated results at 30 June 2023)

Revenues

€1,189 m

Net interest income

€1,044 m

Net income

€383 m

RORWA

2.7%

Loans

€15.2 bn

New loans

€8.4 bn

Branches

327

Customers

>2.8 m