Investing in Mediobanca

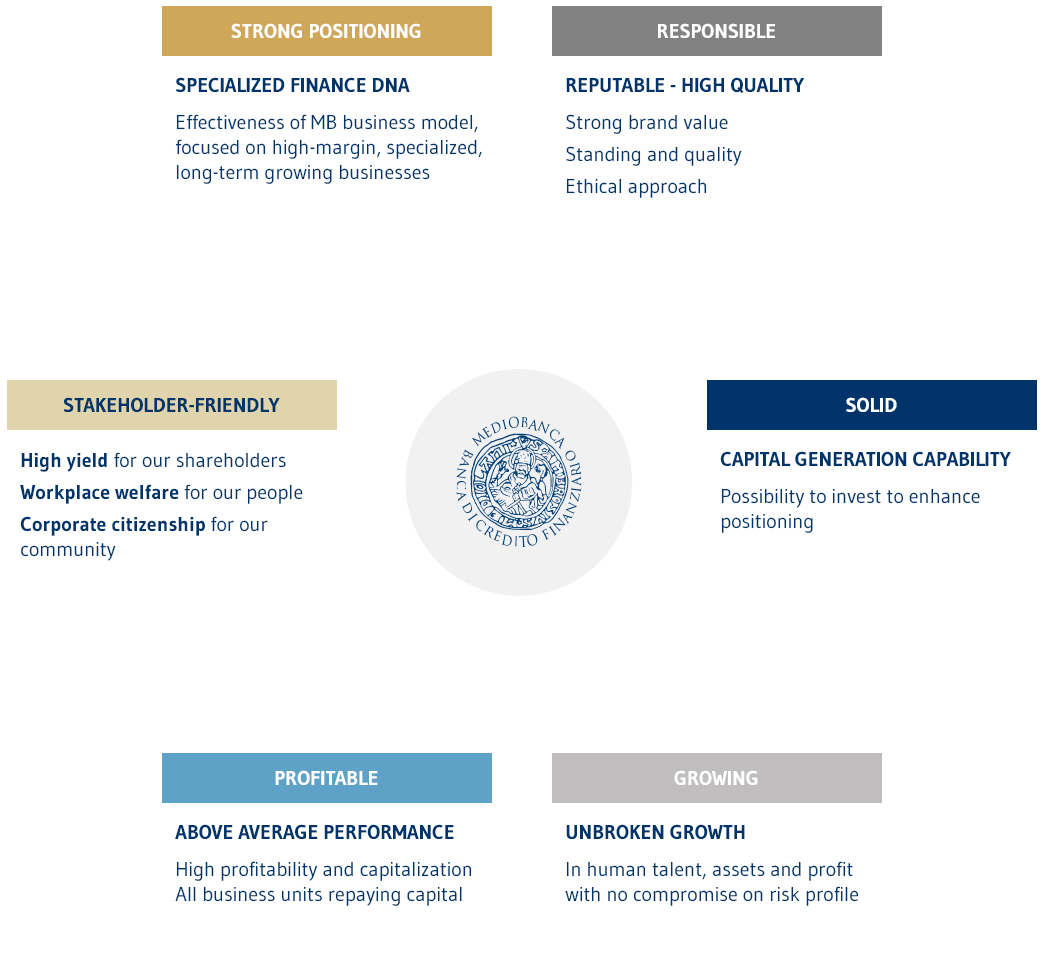

Ranked among the most solid banks in Italy, Mediobanca is a financial group specialised in Wealth Management, Corporate & Investment Banking and Consumer Banking. Low risk profile and highly profitable, sustainability of results over time, professional integrity and unique business model are among the key features that have enabled us to create and consolidate a reputation that is now our hallmark

We have set ourselves apart in the European context for our profitability and market performance, guaranteeing high remuneration of shareholders. The extensive capital resources, the result of management and not of recourse to share capital increases, a risk/return profile among the best in Europe and excellent asset quality ensure us a solid platform for building future growth. The unique business model and proven ability to grow across-cycles enables us to turn the intrinsic criticalities of the current macroeconomic scenario into opportunities to strengthen our position.

Today we are committed to implementing the guidelines of our strategic plan in order to continue our process of growth in wealth management, corporate & investment banking and consumer banking.

- Capital strength, which is based on constant monitoring of costs and risks

- Stability of the Board of Directors and of management over the last 15 years, which guarantees not only in-depth knowledge of the business context but a strategic long-term vision

- Extremely high brand value. Mediobanca has stood part for its reputation built on reliability and quality. The credibility of the group is deeply-rooted in a responsible business approach, correctness and transparency and in the constant focus on ethics and integrity

- Specialisation and innovation

- Sustainable business development, targeted at creating and protecting value for all stakeholders

- ESG strategy integrated in the strategic plan, in order to combine business growth and financial strength with social and environmental sustainability

- Transformation from a holding company to a specialised financial group

- Proven ability to adapt the business model to the regulatory changes and market trends

- Business model focused on highly specialised and income-generating activities, integrated between cyclical and anti-cyclical activities, diversified between retail and corporate, capable of also growing in adverse situations

- History of robust growth without compromising the prudent approach to risk management

- Presence in three business sectors driven by positive structural trends in the long-term

- Reference investment bank in Italy, now a leader also in southern Europe

- Stand-out operator in terms of quality, innovation and value in the Italian wealth management market

- Unique operator in Italy, leader in Corporate & Investment Banking and with a long-established presence in private banking, able to cover all entrepreneurs’ financial needs, particularly in the Mid-Caps segment

- Ranked among the top three operators in Italian consumer credit with Compass

- The Insurance & Principal Investing division, represented almost entirely by the stake in Assicurazioni Generali, constitutes a profitable investment and a value option that can be activated in the event of growth transactions

- Positive track record. Targets of 2019-2023 strategic plan have been over-delivered, despite the challenging macro scenario (Covid-19 crisis and Ukraine-Russia war)

- Growth based on the same level of risk, with no need for share capital increases (the last one dates back to 1998) or restructuring operations

- Excellent asset quality

- Cost base under control

- Increased remuneration of shareholders during the period of the 2019-2023 plan, with approx. €2.2billion distributed through cash dividends (€1.9billion equivalent to 70% cash payout) and share buybacks.

- For the strategic plan 2023-26 remuneration of shareholders is set to increase by 70% to €3.7billion, reflecting €2.7billion of cash dividends (in application of a cash payout ratio of 70%) and €1billion of share buyback and cancellation scheme (with the amount to be determined annually).