Business model and divisions

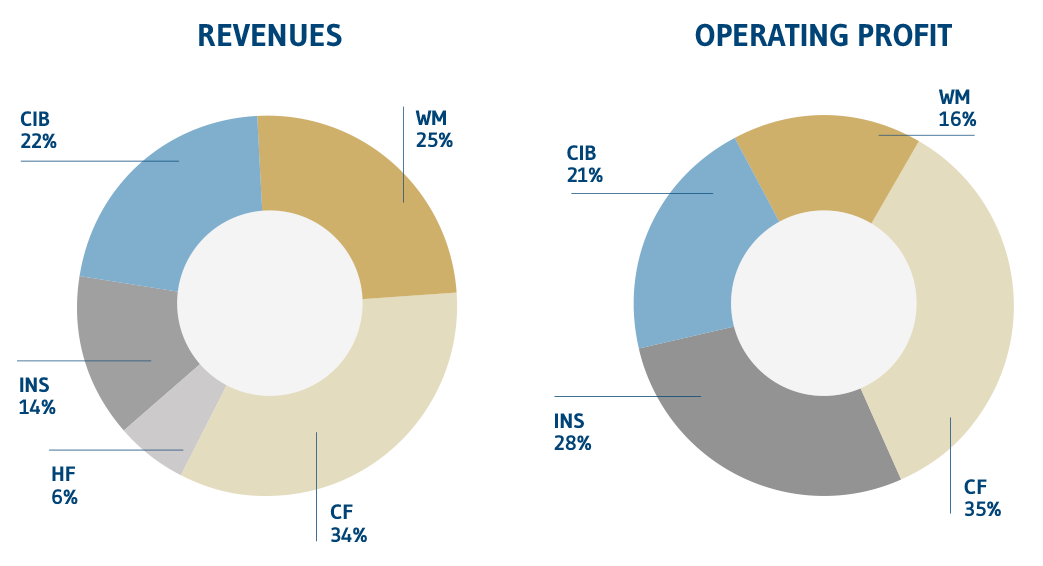

Our distinctive business model is structured in a consistent, diversified and integrated manner. It sets us apart in the Italian banking industry. Our four business areas are each highly specialized with excellent profit margins

Our business model is that of a specialized financial group structured into four divisions that together form a consistent, virtuous organization which enables us to respond to market changes and provides us with ever present opportunities for growth.

In this way, we have successfully withstood the Italian banking market’s negative trends in recent years through:

- a prudent management approach: our asset quality is second to none in Italy and our risk/return ratio ranks among the best in Europe;

- negative interest rates, which, rather than being weaknesses, have spurred the development of our wealth management division, which we are harnessing to drive the Group’s future growth;

- having already achieved compliance with the new and particularly strict banking regulations;

- a low relative dependency on Italy’s macroeconomic situation, with limited exposure to spreads and Italian government securities.

The synergies between Wealth Management and Corporate & Investment Banking (CIB) will be vital growth drivers: we are the only group in Italy to offer customers “double coverage”, meaning Italian business owners rely on us for corporate solutions as well as private banking services.

Our cyclical (CIB) and anti-cyclical (Consumer Finance) divisions balance each other out, ensuring our long-term stability.

The Insurance Division continues to be a highly profitable source of visible and decorrelated cash flows, and a source of capital to fund potential M&A .

MEDIOBANCA: ONE BRAND – ONE CULTURE

WHERE SOPHISTICATED APPROACH IS ORDINARY BUSINESS

Mediobanca will be a leading player for high-value, high-end, complex operations,

executed effectively through Mediobanca’s distinctive

people, culture and accountability

To reach these goals we will leverage substantially on the

Mediobanca Brand and synergistic approach between our businesses

We aspire to be the best place for our people, employees and customers,

remaining anchored to one-of-a-kind “school of responsible banking”

We aim to be a distinctive investment opportunity for our shareholders,

focusing on capital-light, low-risk, profitable growth,

and outperforming the industry on stakeholder remuneration

Our business model has proven its solidity and ability to transform critical market events into opportunities. This has allowed us to emerge as a specialized financial group focused on profitability rather than volumes and capable of achieving robust, sustainable growth. We also expect to benefit in the near future from the opportunities offered by the new and more advantageous valuation techniques based on both financial and non-financial metrics.

Our divisions are highly specialized, active businesses with high profit margins and low capital intensity.

Wealth Management

- Highly specialized business

- Recurring-fee, capital-light business

- Solutions business, profitable even on a smaller scale

- Private Banking activities synergic to CIB

The Wealth Management division has affirmed itself as a respected player in the Italian wealth management market and is poised to play a key role in the Group’s future growth.

Our Wealth Management division serves:

- Premier clients through Mediobanca Premier, the digital bank launched in 2008 and now focused on wealth management;

- High Net Worth Individuals and Ultra High Net Worth Individuals (HNWI and UHNWI) through Mediobanca Private Banking and CMB Monaco, offering services in synergy with those of our Corporate & Investment Banking division.

We also hold specialized asset management boutiques to offer an increasingly distinctive range of proprietary products.

Highlights (annual consolidated results at 30 June 2024)

Revenue

€924million

Operating profit

€303 million

RORWA

3.6%

AUM/AUA

€72 billion

Consumer Finance

- Historical business launched in the 1960s

- Specialized domestic business with high barriers to entry

- Highly profitable revenue stabilizer and interest income driver for the Group

- Significant credit risk fragmentation

Our subsidiary Compass, a pioneer in consumer credit in Italy, boasts 70 years of history. Bolstered by its in-depth understanding of the market, it now ranks third in the country. It is solid, reliable and profitable thanks to strategies that have always been geared towards the sustainability of results over time.

Compass will further develop its distribution channels, which guarantee greater revenue, more stability and better control. In addition, it will invest in significant digital innovation to keep up with and anticipate consumer trends.

This division is the largest contributor to the Group’s revenue and operating profit.

Highlights (annual consolidated results at 30 June 2024)

Revenue

€1,189 million

Loan Book

€15.2 billion

Operating profit

€570 million

RORWA

2.7%

Branches

327

Corporate & Investment Banking

- Historically part of Mediobanca’s DNA

- Specialized customer-driven business

- Profitable but cyclical, fee-based business

- Well diversified in terms of sources and products, and now geographically as well

We are the number one merchant bank in Italy and a leader in Southern Europe. We provide top-tier advisory services and specialized lending solutions. We serve our customers by prioritizing their interests and the most appropriate solutions, which range from the simplest to the most sophisticated on financial markets.

Despite the less than ideal market context, Mediobanca’s CIB business has preserved revenue, profitability and asset quality, proving to be one of the most resilient players in Europe. Our partnership with Arma partners and synergies with private banking will drive future growth.

Highlights (annual consolidated results at 30 June 2024)

Revenue

€763 million

Loan Book

€ 19.0 billion

Operating profit

€393 million

RORWA

1.4%

Insurance

The legacy portfolio was progressively divested and this division currently consists almost exclusively of the investment in Assicurazioni Generali, which presents positive returns and anchors the Group's revenue and earnings.

Highlights (annual consolidated results at 30 June 2024)

Revenue

€530 million

Operating profit

€525 million

RORWA

3.8%

Equity exposure

€4.6 billion