The role of Wealth Management

Since 2016, asset management and private banking, combined in the Wealth Management division, have been a cornerstone of our business model. This division is now a crucial growth driver as it reinforces our profile as a specialized financial group

With the launch of the Wealth Management division, which was the centrepiece of the 2016-2019 business plan, in the span of a few years we have emerged as one of the most dynamic and attractive players in the Italian wealth management and private banking market.

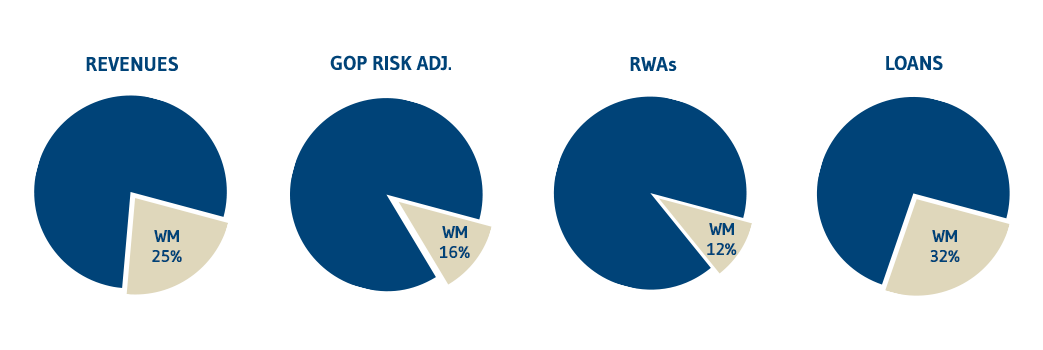

Affluent customer services, private banking and asset management are highly specialized businesses that complement and create synergies with our merchant bank business. These types of services are also a steady source of revenue and ensure excellent profitability. Furthermore, the European regulatory framework outlined in Basil 3, which sets increasingly tighter capital requirements, makes low capital intensity businesses essential to mitigate the absorption of the group’s capital.

In the past few years, we have focused on this division’s organization and growth by:

- creating Mediobanca Private Banking through the acquisition of Banca Esperia and its merger into Mediobanca Spa;

- doubling the operations of Mediobanca Premier in the Affluent customer segment with the acquisition of Barclays Italia's retail banking business, the first step in Mediobanca Premier’s transformation from a deposit gatherer to an asset gatherer for the Premier customer segment;

- MB Asset Management includes Mediobanca Sgr, RAM Active Investments and Polus Capital Management (former Cairn Capital after merger with Bybrook). The development of our proprietary specialized asset management boutiques enables us to propose distinctive, top-tier products that enhance our offer, particularly with respect to illiquid and niche products..

In a few short years, the WM division, which changed the group’s identity and profile, became a major fee contributor, generating over 50% of total group fees. We now plan to develop and establish our distinctive reputation as a group founded on professionalism, solidity and innovation in this area as well.

Highlights (annual consolidated results at 30 June 2024)

Our group will consolidate its positions with:

- a widely recognizable brand and position;

- capital reserves to invest in potential acquisitions;

- group synergies;

- transparency and fair pricing, which we have always created and designed in accordance with strict pricing regulations.

Our WM business model pivots on three business lines.

We serve private banking customers in Italy with Mediobanca Private Banking, which was founded in 2017 through the merger of Banca Esperia into Mediobanca Spa, and customers in Monaco with CMB Monaco. We will increasingly leverage synergies between Private Banking and the CIB division to satisfy our business owner customers by meeting both their personal investment requirements and corporate growth and development needs.

We support our Premier clientele through Mediobanca Premier, the bank specializing in wealth management and investments for Italian households.

Mediobanca Premier is the most recent incarnation of the Group’s Wealth Management division, combining the advisory model of CheBanca!, the innovative digital bank set up in 2008, with the competence and solidity of Mediobanca.

Learn more

MB Asset Management includes Mediobanca Sgr, RAM Active Investments and Polus Capital Management. The development of our proprietary specialized asset management boutiques enables us to propose distinctive, top-tier products that enhance our offer, particularly with respect to illiquid and niche products.

Highlights (annual consolidated results at 30 June 2024)

Customers

> 780,000

Sales force

1,306

Revenue

€924 million

Net Interest income

€425 million

Net fee income

€489 million

RORWA

3.6%

Operating profit

€303 million

AUM/AUA

€71.5 billion

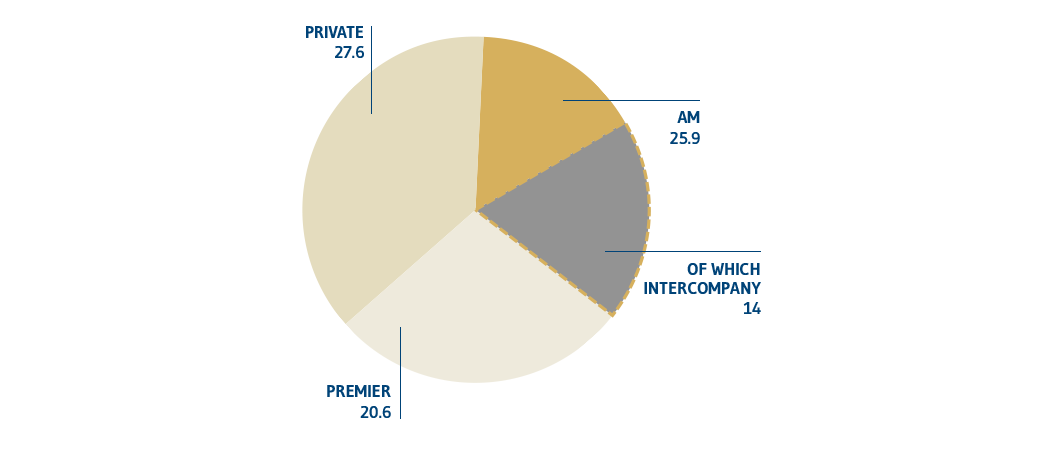

AUM/AUA by segment (€bn)