Financial markets

We operate on capital markets through equity transactions (IPOs, capital increases, and convertible bonds), placements of debt instruments, and as brokers.

We support companies at decisive times in their growth that impact on their financial structure, such as IPOs (Initial Public Offerings), capital increases or convertible bond issues. We also offer equity brokerage services (through Mediobanca Research) and corporate finance services (equity investments and treasury shares).

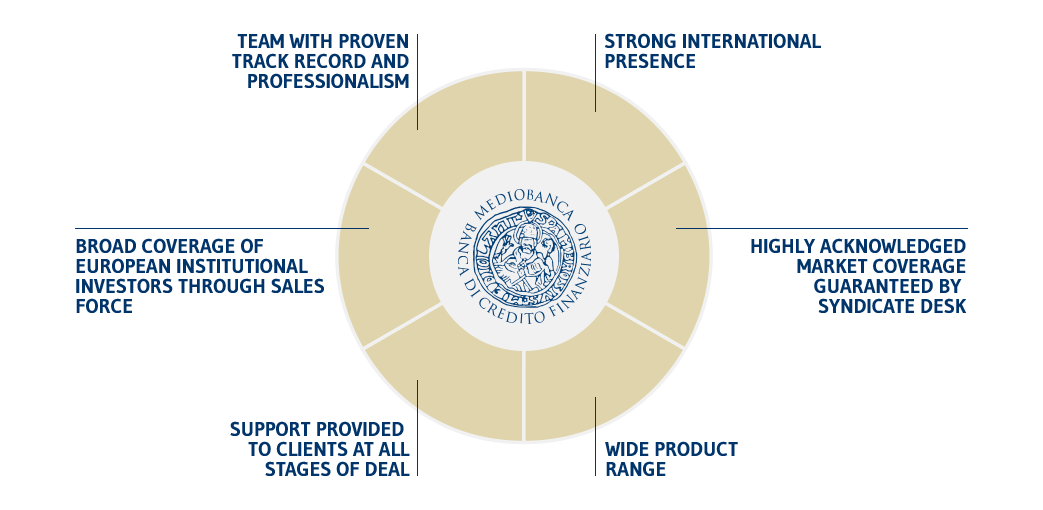

We are leader in equity market placements in Italy, with a growing role at European level. Our Equity Capital Markets (ECM) team has a proven track record in structuring, co-ordinating and executing capital markets deals, including:

- Initial Public Offerings (IPOs)

- Rights issues with options

- Secondary offerings and Accelerated Bookbuilding Offerings (ABOs)

- Issues of convertible/equity-linked bonds).

Our equity sales platform has repeatedly been voted as best brokerage house for both Italian and international investors, and guarantees unique market access for companies and investment funds.

The Equity Capital Markets team is made up of professionals with an outstanding track record, acknowledged by clients and investors alike. Our professionals:

- Have participated in all the most important deals in Italy, and are increasing their coverage of the European market

- Are able to successfully complete large and complex deals, even in unhelpful market conditions.

Mediobanca Research is our equity brokerage division. With over 50 professionals working out of London, Milan, Paris and New York, Mediobanca Research offers an integrated service encompassing equity research, sales and trading in Italian equities (over 100 companies covered) and international stocks.

Mediobanca Research website (reserved access): www.mediobancaresearch.com

The Equity Solutions team structures and executes corporate finance deals involving equities and treasury shares, including:

- Security-backed loans, with and without recourse

- Management of equity investments: increasing profitability, coverage and monetization

- Structuring and financing the acquisition of investments in listed companies

- Management of treasury shares and stock option schemes

- Optimization of capital structure.

We provide our customers, mainly institutional investors, with investment solutions that are index-linked to financial markets, tailoring their complexity to our customers’ needs, ranging from plain vanilla to more sophisticated solutions.

We offer solutions in the areas of securities lending (stock loans, synthetic products, exclusive lending/borrowing programmes, etc.), equity repos and cash financing.

We manage bond issues and private placements and structure interest rate, credit and alternative product solutions.

Our Debt Capital Markets team supports industrial and financial clients in the placement of debt securities (bonds and asset-backed notes), both public and private placements.

Our services cover every phase of the transaction, from structuring to distribution, and all product types (including senior bonds, covered bonds, subordinated debt, hybrid securities, securitizations, etc.)

Our DCM Team, which has a prove track record and solid professionalism, has been involved in almost 400 deals in the last seven years, through its extensive coverage of domestic and international issuers and, and continual searching for across-the-board solutions to meet our clients’ many needs. Ongoing dialogue between the salesforce split between Milan and London supports underpins our extensive coverage of the leading European investors active on the corporate market (IG and HY) and FIG market.

Our Fixed-Income Solutions team mainly serves institutional clients with a need to restructure their portfolios, structure investment products, increase asset liquidity, and diversify their sources of financing.

These services include structuring interest rate and credit solutions and alternative products to meet investment requirements ranging from private banking customers to corporate treasury departments, to the optimization of financial institutions’ capital structures.

Mediobanca Studies has been well-known for decades for its outstanding analysis and exceptional reports which serve as a benchmark for many business sectors and economic issues. Our research is distinctive for our high-quality information, impartial position, and original approach. We cover two main areas: financial market analysis, and research on companies and business sectors.

Mediobanca Studies website: www.areastudimediobanca.com

Equity Capital Markets: info.equity.capital.markets@mediobanca.it

Mediobanca Securities: mediobanca.securities@mediobanca.com

Equity Solutions: info.equity.solutions@mediobanca.it

Equity Derivatives Institutional Marketing: info.equity.capital.markets@mediobanca.it

Equity Finance: info.Equity.Finance@mediobanca.it

Debt Capital Markets: MB_DCM_info@mediobanca.com

CRAL Solutions: info.cral.solutions@mediobanca.com

Area Studi MBRES: res@mbres.it