Funding and rating

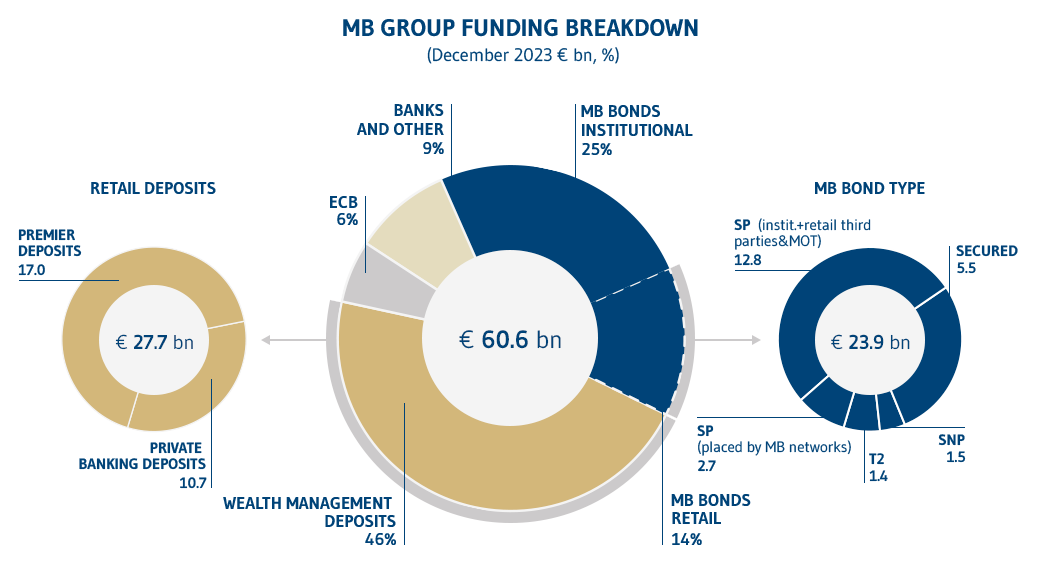

Our funding strategy has changed and diversified significantly over the years. Bond issues now account for less than half of our funding, compared with more than 60% in 2005, in 2008 we launched Mediobanca Premier to access retail deposits.

Overall about 57% of our funding now comes from retail investors: 13% from our bonds sold to retail customers, while 43% of our funding is raised from Wealth Management deposit.

Our dedicated Products issued website contains all the details for our issues (prospectuses, types, maturities, recipients, etc.).

- Well diversified funding structure: 57% retail (13% bonds, 44% WM deposits) and 43% institutional (32% securities, 11% banks and other)

- MB securities totaling €28.7bn: €18.5bn senior preferred, €2bn SNP, €1.7bn T2, €6.5bn secured

- Wealth Management deposits at €28.2bn: €17.9bn Premier, €10.3bn Private Banking

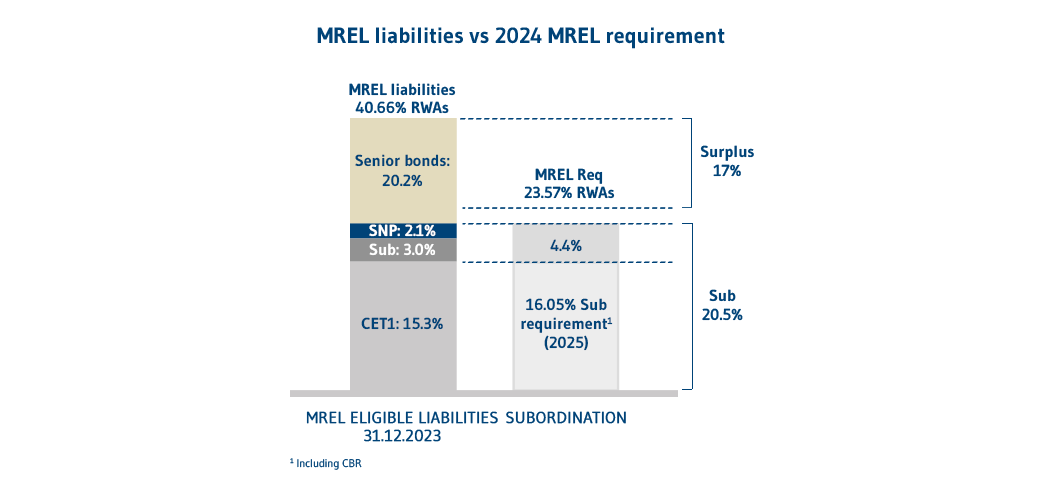

MREL requirement for 2024 among the lowest in EU:

- 23.57% RWA

- 5.91% LRE (Leverage Ratio Exposure)

- MREL own funds and eligible liabilities at 43.50%of RWAs

- with a surplus of approx. 20% of RWAs vs MREL requirement

- Over 90% of MREL requirement covered by own funds and subordinated debt

Funding and liquidity indicators (at 30 June 2024)

| LCR | NSFR |

|---|---|

| 159% | 117% |