The excellent performances over the last 10 years are the result of the process, launched in 2003, of in-depth evolution of Mediobanca, which transformed the group from a holding company to a highly specialised financial operator, with higher focus on k-light activities.

| (€M) |

JUN14 |

JUN15 |

JUN16 |

JUN17 |

JUN18 |

JUN19 |

JUN20 |

JUN21 |

JUN22 |

JUN23 |

JUN24 |

| NET INTEREST INCOME |

1087 |

1143 |

1207 |

1288 |

1359 |

1396 |

1442 |

1415 |

1479 |

1801 |

1985 |

| NET TREASURY INCOME |

45 |

207 |

133 |

121 |

157 |

197 |

136 |

197 |

162 |

206 |

172 |

| NET FEE INCOME |

424 |

472 |

450 |

523 |

622 |

611 |

630 |

745 |

851 |

844 |

939 |

| EQUITY-ACCOUNTED COMPANIES |

264 |

224 |

257 |

264 |

280 |

321 |

304 |

272 |

359 |

454 |

510 |

| TOTAL INCOME |

1819 |

2045 |

2047 |

2196 |

2419 |

2525 |

2513 |

2628 |

2851 |

3305 |

3607 |

| OPERATING COSTS |

-791 |

-847 |

-892 |

-1024 |

-1115 |

-1162 |

-1189 |

-1238 |

-1312 |

-1413 |

-1542 |

| LOAN LOSS PROVISIONS |

-736 |

-533 |

-419 |

-317 |

-247 |

-223 |

-375 |

-249 |

-243 |

-270 |

-252 |

| OPERATING PROFIT |

292 |

666 |

736 |

855 |

1057 |

1140 |

949 |

1142 |

1296 |

1621 |

1813 |

| OTHER INCOME (LOSSES) |

209 |

92 |

1 |

59 |

39 |

-56 |

-154 |

-37 |

-127 |

-193 |

-76 |

| PROFIT BEFORE TAX |

501 |

757 |

736 |

914 |

1096 |

1084 |

795 |

1104 |

1169 |

1428 |

1736 |

| NET PROFIT |

465 |

590 |

605 |

750 |

864 |

823 |

600 |

808 |

907 |

1027 |

1273 |

| (€M) |

JUN.14 |

JUN.15 |

JUN.16 |

JUN.17 |

JUN.18 |

JUN.19 |

JUN.20 |

JUN.21 |

JUN.22 |

JUN.23 |

JUN.24 |

| NET INTEREST INCOME |

1087 |

1143 |

1207 |

1288 |

1359 |

1396 |

1442 |

1415 |

1479 |

1801 |

1985 |

| NET TREASURY INCOME |

45 |

207 |

133 |

121 |

157 |

197 |

136 |

197 |

162 |

206 |

172 |

| NET FEE INCOME |

424 |

472 |

450 |

523 |

622 |

611 |

630 |

745 |

851 |

844 |

939 |

| EQUITY-ACCOUNTED COMPANIES |

264 |

224 |

257 |

264 |

280 |

321 |

304 |

272 |

359 |

454 |

510 |

| TOTAL INCOME |

1819 |

2045 |

2047 |

2196 |

2419 |

2525 |

2513 |

2628 |

2851 |

3305 |

3607 |

| OPERATING COSTS |

-791 |

-847 |

-892 |

-1024 |

-1115 |

-1162 |

-1189 |

-1238 |

-1312 |

-1413 |

-1542 |

| LOAN LOSS PROVISIONS |

-736 |

-533 |

-419 |

-317 |

-247 |

-223 |

-375 |

-249 |

-243 |

-270 |

-252 |

| OPERATING PROFIT |

292 |

666 |

736 |

855 |

1057 |

1140 |

949 |

1142 |

1296 |

1621 |

1813 |

| OTHER INCOME (LOSSES) |

209 |

92 |

1 |

59 |

39 |

-56 |

-154 |

-37 |

-127 |

-193 |

-76 |

| PROFIT BEFORE TAX |

501 |

757 |

736 |

914 |

1096 |

1084 |

795 |

1104 |

1169 |

1428 |

1736 |

| NET PROFIT |

465 |

590 |

605 |

750 |

864 |

823 |

600 |

808 |

907 |

1027 |

1273 |

| 0 |

JUN14 |

JUN15 |

JUN16 |

JUN17 |

JUN18 |

JUN19 |

JUN20 |

JUN21 |

JUN22 |

JUN23 |

JUN24 |

| TREASURY, AFS AND HTM |

19789 |

14777 |

16322 |

16455 |

13327 |

12734 |

13760 |

14418 |

16685 |

16293 |

18677 |

| EQUITY INVESTMENTS |

2871 |

3411 |

3163 |

3037 |

3211 |

3260 |

3205 |

3703 |

3158 |

3564 |

3789 |

| LOANS TO CUSTOMERS |

30552 |

32890 |

34739 |

38191 |

41128 |

44394 |

46685 |

48414 |

51701 |

52549 |

52447 |

| FUNDING |

45834 |

42711 |

46658 |

49121 |

46893 |

51393 |

54917 |

56156 |

61169 |

60506 |

63670 |

| SHAREHOLDERS’ EQUITY |

7373 |

8169 |

8922 |

9192 |

9732 |

9899 |

9740 |

11101 |

10749 |

11429 |

11243 |

| RWAS |

58744 |

59577 |

53862 |

52709 |

47363 |

46310 |

48030 |

47159 |

50378 |

51432 |

47622 |

| NO. OF STAFF |

3570 |

3790 |

4036 |

4798 |

4717 |

4805 |

4920 |

4921 |

5016 |

5227 |

5443 |

| CT1 RATIO (%) |

11,1 |

12 |

12,1 |

13,3 |

14,2 |

14,1 |

16,1 |

16,3 |

15,7 |

15,9 |

15,2 |

| COST/INCOME RATIO (%) |

43 |

41 |

44 |

47 |

46 |

46 |

47 |

47 |

46 |

43 |

43 |

| COST OF RISK (BPS) |

230 |

168 |

124 |

87 |

62 |

52 |

82 |

52 |

48 |

52 |

48 |

| |

JUN.14 |

JUN.15 |

JUN.16 |

JUN.17 |

JUN.18 |

JUN.19 |

JUN.20 |

JUN.21 |

JUN.22 |

JUN.23 |

JUN.24 |

| TREASURY, AFS AND HTM |

19789 |

14777 |

16322 |

16455 |

13327 |

12734 |

13760 |

14418 |

16685 |

16293 |

18677 |

| EQUITY INVESTMENTS |

2871 |

3411 |

3163 |

3037 |

3211 |

3260 |

3205 |

3703 |

3158 |

3564 |

3789 |

| LOANS TO CUSTOMERS |

30552 |

32890 |

34739 |

38191 |

41128 |

44394 |

46685 |

48414 |

51701 |

52549 |

52447 |

| FUNDING |

45834 |

42711 |

46658 |

49121 |

46893 |

51393 |

54917 |

56156 |

61169 |

60506 |

63670 |

| SHAREHOLDERS’ EQUITY |

7373 |

8169 |

8922 |

9192 |

9732 |

9899 |

9740 |

11101 |

10749 |

11429 |

11243 |

| RWAS |

58744 |

59577 |

53862 |

52709 |

47363 |

46310 |

48030 |

47159 |

50378 |

51432 |

47622 |

| NO. OF STAFF |

3570 |

3790 |

4036 |

4798 |

4717 |

4805 |

4920 |

4921 |

5016 |

5227 |

5443 |

| CT1 RATIO (%) |

11,1 |

12 |

12,1 |

13,3 |

14,2 |

14,1 |

16,1 |

16,3 |

15,7 |

15,9 |

15,2 |

| COST/INCOME RATIO (%) |

43 |

41 |

44 |

47 |

46 |

46 |

47 |

47 |

46 |

43 |

43 |

| COST OF RISK (BPS) |

230 |

168 |

124 |

87 |

62 |

52 |

82 |

52 |

48 |

52 |

48 |

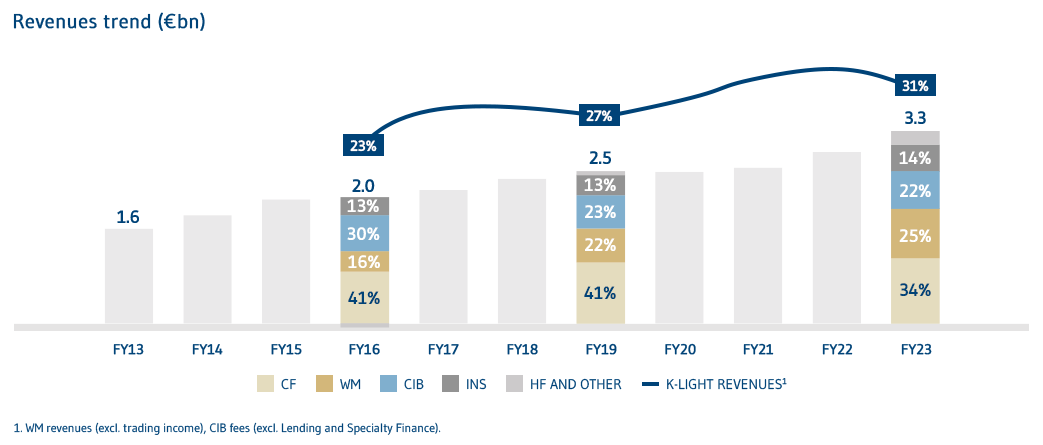

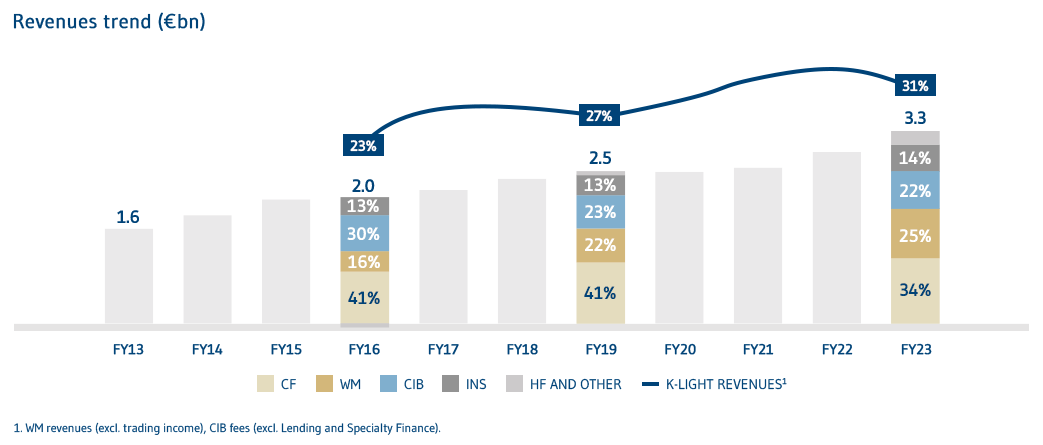

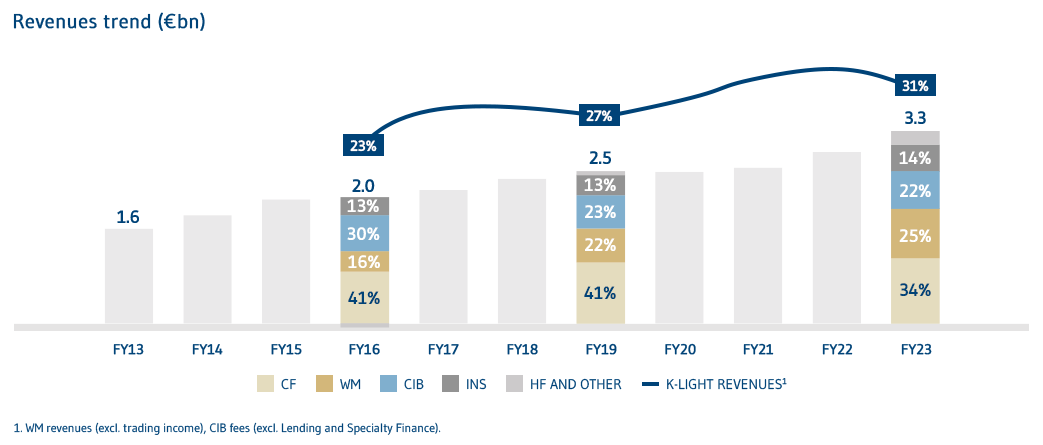

- In the last decade we have doubled our revenues to €3.6bn, consistently achieving our targets

- All business segments have been enlarged, contributing positively to growth and profitability

- Revenue quality enhanced by broader diversification and growing contribution from capital-light activities

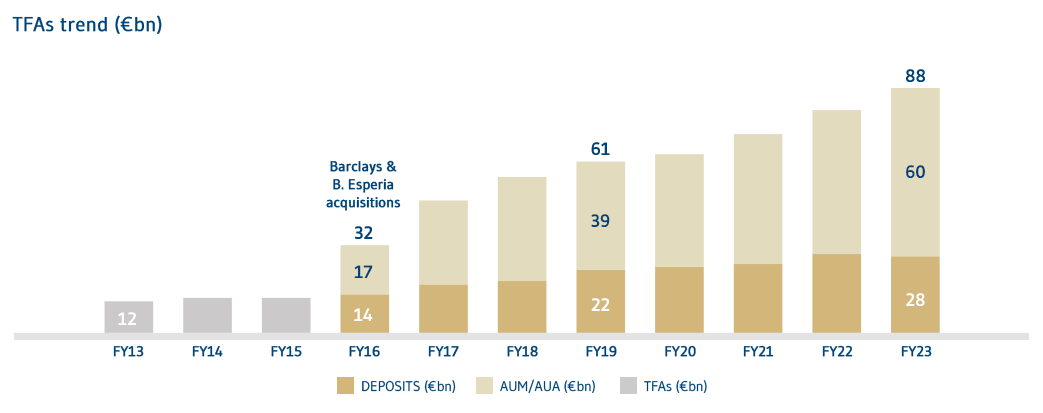

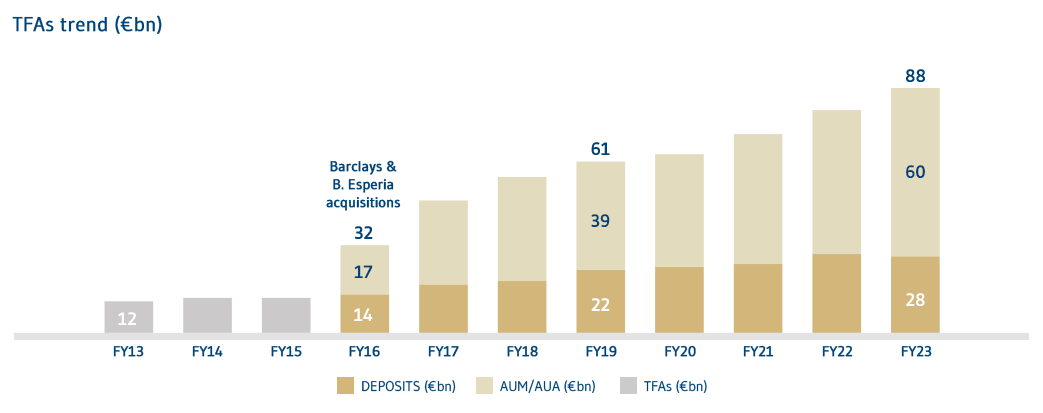

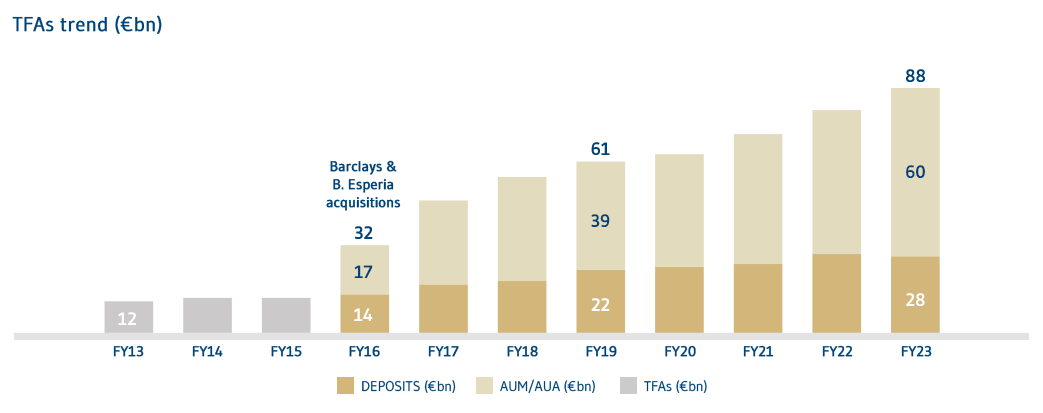

- Since 2016, when Mediobanca effectively entered in the WM business, TFAs have tripled (to approx. €100bn) due to MB Private-Investment Banking model adoption, and significant investment in distribution and acquisitions

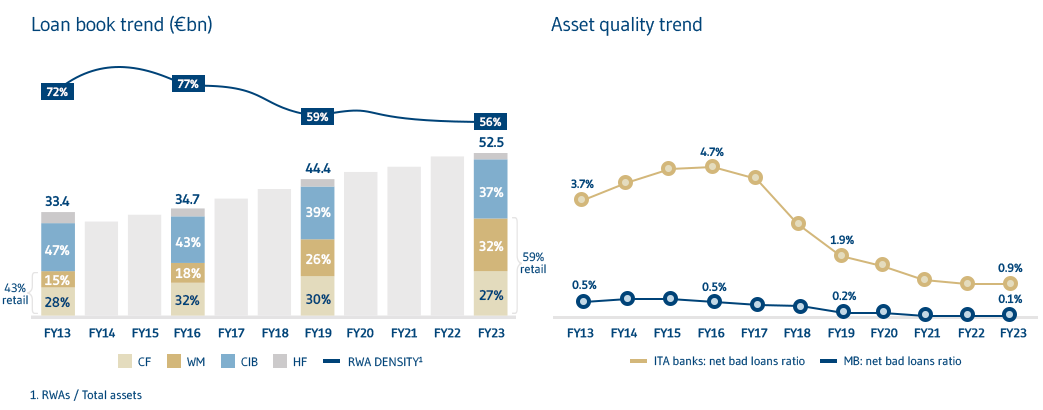

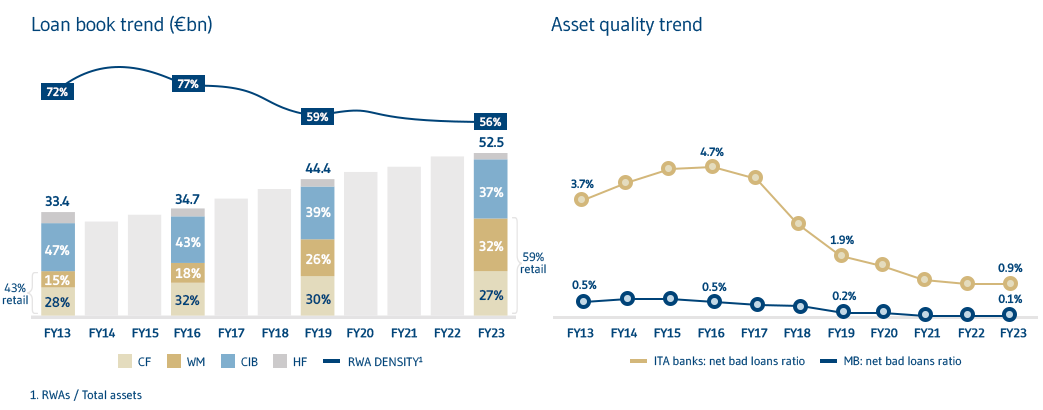

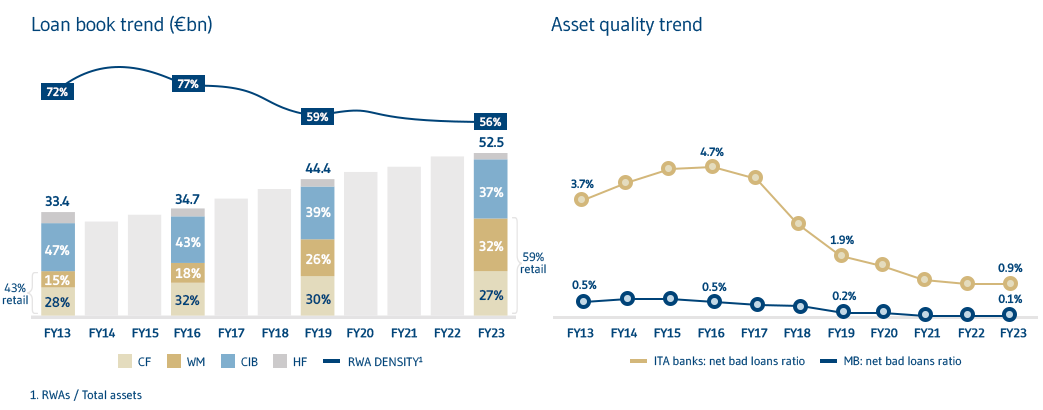

- In the last 10Y MB loan book increased by more than €20bn to €52bn, becoming more diversified with a higher retail share from 49% to 61% (increased mainly in WM)

- RWA density reduced from 83% to 48% due to ongoing capital absorption optimization mainly in CIB

- The selective and value-driven approach that has always characterized our loan origination policy allowed to maintain a

healthy and best-in-class asset quality, without recurring to any large NPL disposal

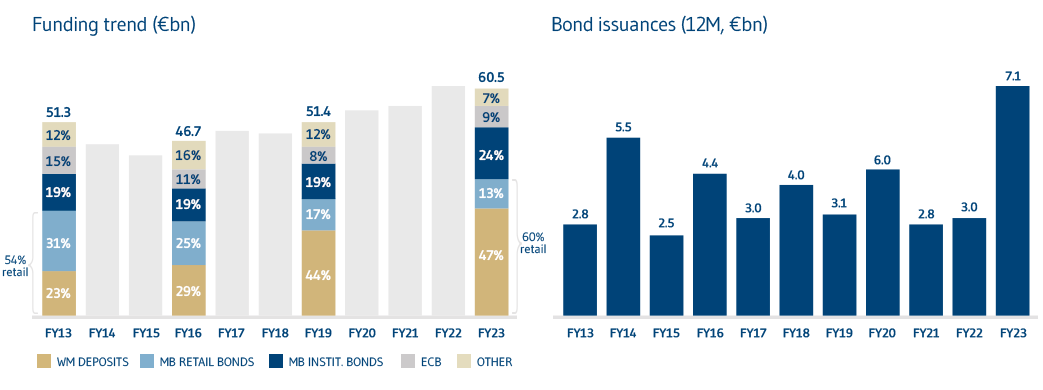

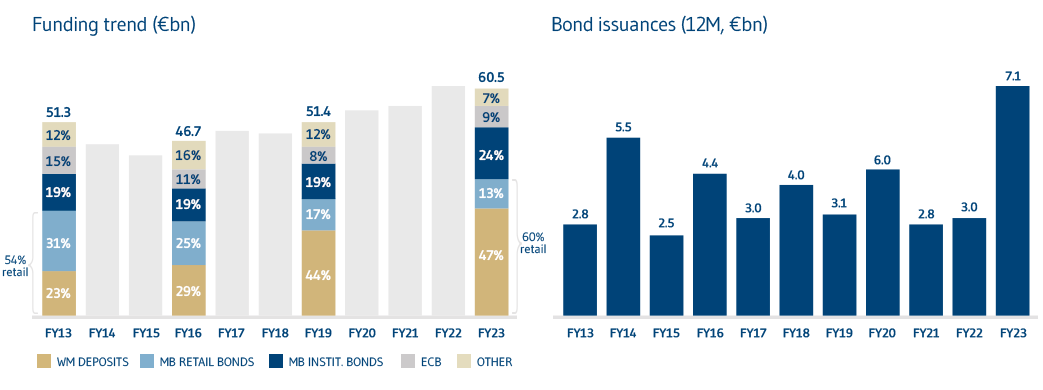

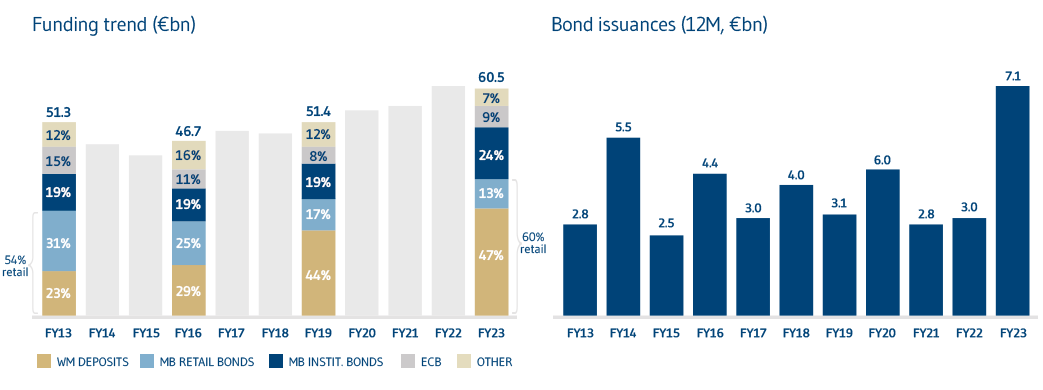

- In the last decade Group funding increased by almost €20bn to €64bn, backed by solid WM deposits growth whose contribution to Group funding almost doubled from 25% to 44%

- Access to bond market has always been wide even during crisis periods, with a mix that has evolved over time in favour of the institutional component

- Reliance on ECB funding has always been contained and reduced to 2% of Group funding as at June 2024

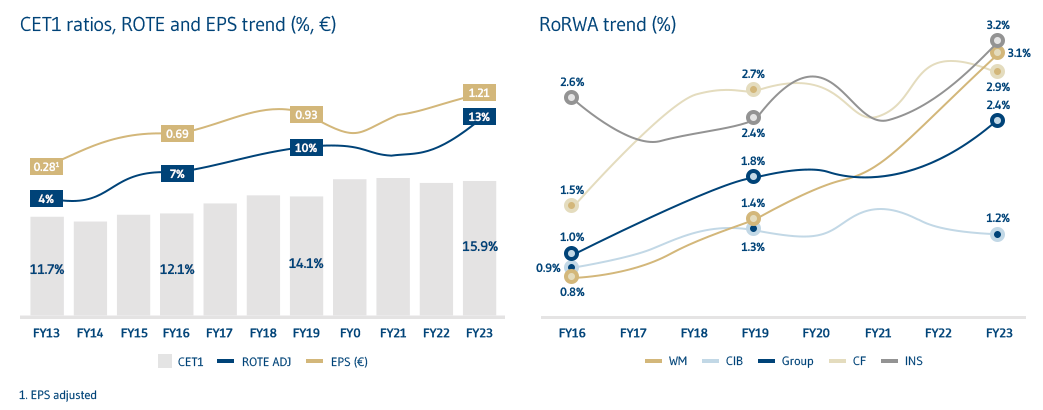

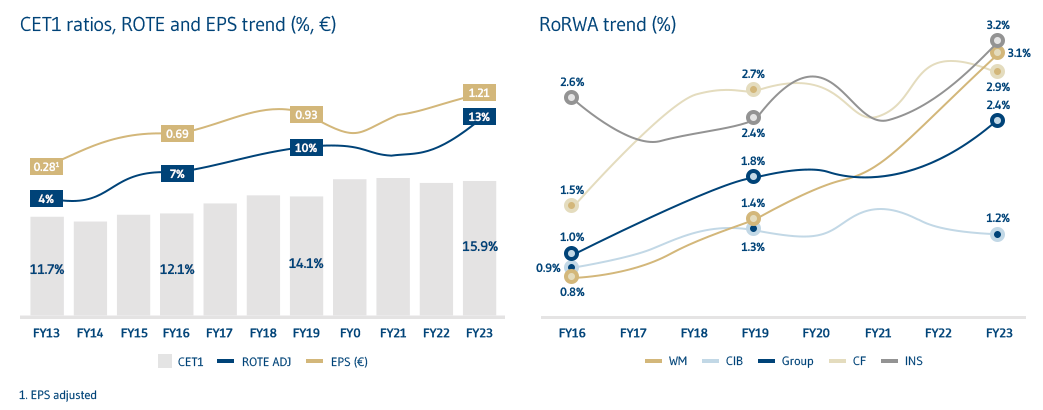

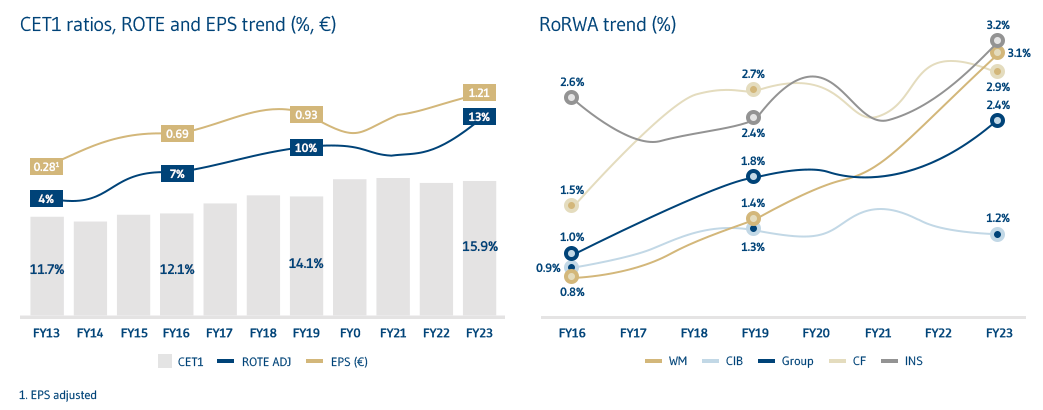

- Capital generation has enabled solid CET1 ratios, without capital increases

- Earnings per share increased steadily due to a combination of organic growth, acquisitions and share buybacks

- Profitability ramped up sustainably, mainly driven by WM

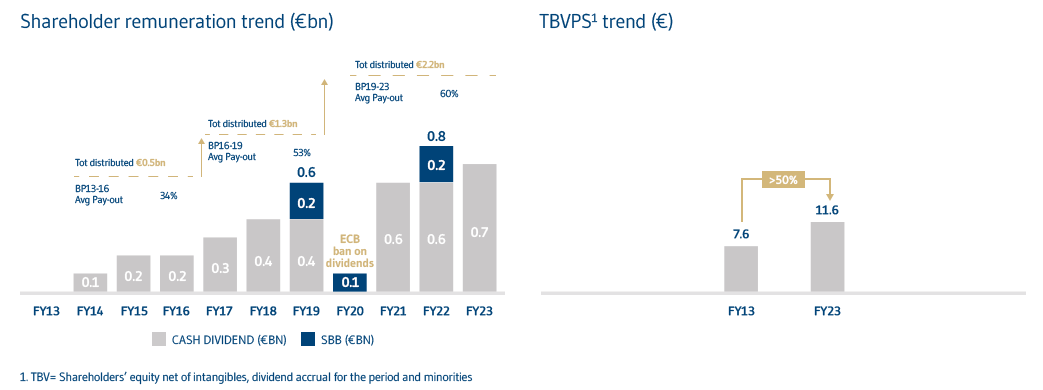

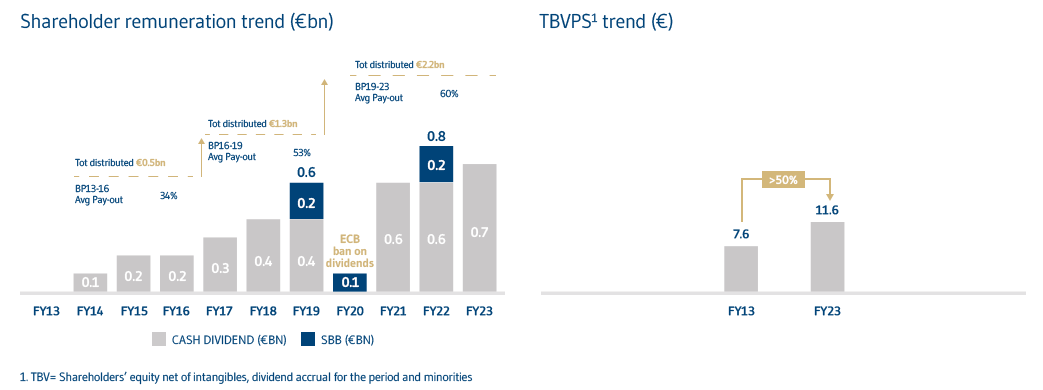

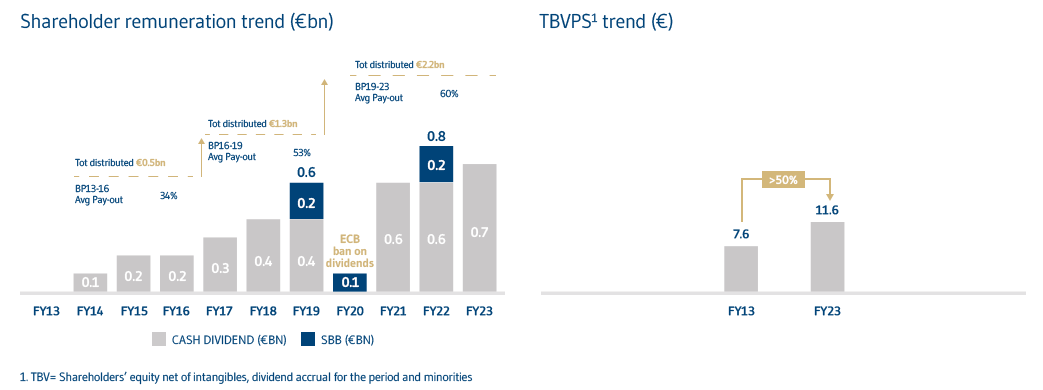

- Shareholder remuneration increased to 85% total payout in FY24

- Over €5bn distributed in last 10Y, of which €1.1bn in the first year of BP23-26 (which envisages a cumulated distribution of €3.7bn in 3Y)

- In the last decade tangible book value per share has also increased by 37% to €11.6