Acquisitions and disposals

IN RECENT YEARS WE HAVE CHANGED OUR STRATEGY, UNWINDING OUR EQUITY INVESTMENTS TO FREE UP RESOURCES FOR M&A DEALS IN OUR CORE BUSINESS AREAS

The transformation of our business model, which in the past ten years has seen us change from a holding company to a specialized financial group, is now complete, and our equity investment portfolio now consists almost exclusively of our 13% stake in Assicurazioni Generali.

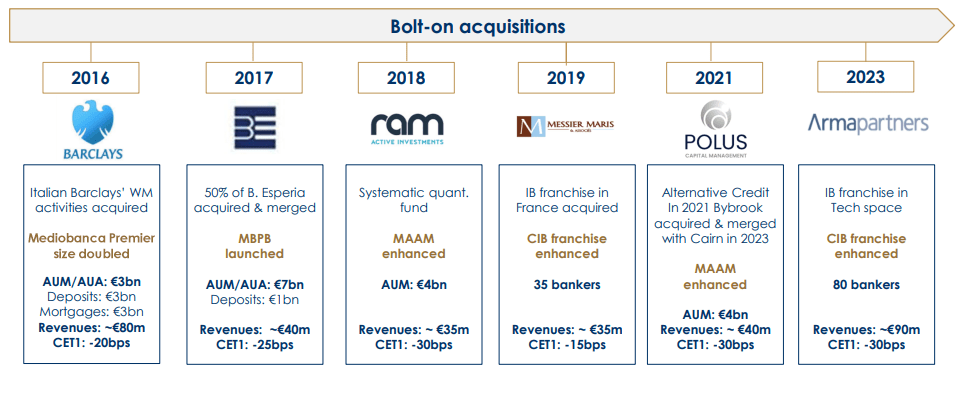

The acquisitions strategy launched in June 2013 was a genuine turning point for us, as prior to this point Mediobanca had always prioritized organic growth. We focused primarily on developing the Wealth Management Division, with the acquisition of the other 50% we did not already own in Banca Esperia, Barclays’ Italian retail operations, and several specialized fund managers: Cairn Capital (which has since become Polus Capital, following the merger with Bybrook), Ram AI and Bybrook.

Our growth through acquisitions strategy also involved the Corporate & Investment Banking Division, enabling Mediobanca to strengthen its footprint in France with the acquisition of French boutique Messier et Associés in April 2019, and in the Digital Economy sector, through the acquisition of Arma Partners LLP in October 2023.

In Consumer Finance, M&A activity has primarily involved the acquisition of fintechs (HeidiPay Switzerland AG and Soisy), to obtain the technological expertise required to strengthen our proprietary digital platform.

Our strong capital position enables us to maintain an approx. 100 bps buffer, calculated based on a minimum CET1 FL ratio of 13.5%, for possible M&A opportunities to support the Group’s business development. Our 13% stake in Assicurazioni Generali also provides us with an additional source of capital for growth via acquisitions.

Through the course of the 2023-26 Strategic Plan, we intend to pursue our expansion policy through targeted acquisitions of companies that are able to accelerate growth in our core businesses, with a preference for capital-light and high fee-generating activities. In choosing possible targets, consideration will also be given to issues such as cultural fit and an ethical approach to business. Acquisitions will meet the criteria which our Group has always set in terms of value creation.

| DATE | ACQUISITION | DISPOSAL |

|---|---|---|

| OCTOBER 2023 | COMPASS EXPANDS IN SWITZERLAND BY ACQUIRING 100% OF HEIDIPAY SWITZERLAND AG | |

| OCTOBER 2023 | MEDIOBANCA FURTHER DEVELOPS ITS ADVISORY BUSINESS THROUGH STRATEGIC INVESTMENT IN ARMA PARTNERS | |

| FEBRUARY 2021 |

CAIRN CAPITAL TO ACQUIRE BYBROOK CAPITAL, MEDIOBANCA RETAINS ITS MAJORITY STAKE |

|

| APRIL 2019 | MEDIOBANCA AND MESSIER MARIS TIGHTEN LONG-TERM STRATEGIC PARTNERSHIP | |

| NOVEMBER 2017 | 69% STAKE IN RAM ACQUIRED. | |

| OCTOBER 2017 | SALE OF EQUITY INVESTMENT IN ATLANTIA | |

| 4TH QUARTER OF 2016-2017 | SALE OF 2.7% OF ITALMOBILIARE | |

| 3RD QUARTER OF 2016-2017 | SALE OF 5.1% OF KOENIG & BAUER | |

| APRIL 2017 | FULL CONTROL OF BANCA ESPERIA ACQUIRED | |

| OCTOBER 2016 | SPAFID, MEDIOBANCA GROUP COMPANY, ACQUIRES FIDER SRL, AN IMPORTANT MILAN TRUST COMPANY | |

| 1Q FY 2016-2017 | SALE OF 1.3% OF ATLANTIA | |

| AUGUST 2016 | ACQUISITION OF PERIMETER OF RETAIL ACTIVITIES OF BARCLAYS IN ITALY THROUGH CHEBANCA! | |

| 2Q FY 2015-16 | SALE OF 3 MILLION IN SHARES OF ASSICURAZIONI GENERALI (EQUAL TO 0.22% OF THE SHARE CAPITAL) | |

| 2Q FY 2015-16 | SALE OF EQUITY INVESTMENT (5.1%) IN EDIPOWER | |

| 1Q FY 2015-16 |

SALE OF EQUITY INVESTMENT IN PIRELLI THROUGH THE TAKE-OVER BID TO THE OPA CARRIED OUT BY MARCO POLO INDUSTRIAL HOLDING |

|

| AUGUST 2015 | ACQUISITION OF CONTROL OF CAIRN CAPITAL GROUP LTD, ASSET MANAGEMENT AND ADVISORY COMPANY WITH REGISTERED OFFICE IN LONDON SPECIALISED IN CREDIT PRODUCTS |