New frontiers in technology

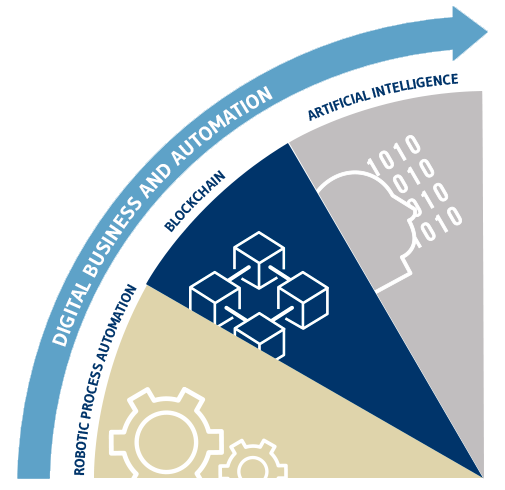

Consistent monitoring of trends in technology is a fundamental prerequisite for pursuit of an innovation strategy over the medium and long term, and serves as the basis for the research and experimentation with new solutions to be implemented in order to improve the Bank’s systems and offering provided to clients.

We engage in ongoing dialogue with leading operators working in the area of innovation, such as providers, advisors, research institutions and universities. We are active participants in sector conferences, to ensure that we remain continuously aligned with the market. To ensure that innovation is integrated into the Group, we pursue a systematic process that combines external stimuli with the new needs that arise within the organization itself, to draw up a practical roadmap of priorities in line with the business divisions’ strategic objectives.

The IT governance activities carried out in recent years have enabled us to participate in some important innovation projects within the Italian banking system and to implement new technologies to improve the services we offer.

In conjunction with Cetif Advisory and with the support of Reply and Linklaters, we have launched the first Italian initiative for the tokenization of investment fund units. The project has been developed as part of the regulatory sandbox instituted by the Italian ministry for the economy and finance, which included the involvement of the Mediobanca Group: the parent company in co-ordinating the activities, Mediobanca SGR as fund manager, and Mediobanca Premier in placing the fund.

The project is based on a process in which the tokenization mirrors the traditional processes. To conduct the experiment, the (“mirroring”) the “Mediobanca Global Multimanager 35” fund managed by Mediobanca SGR was selected, and a new class (T) instituted, represented also in digital form, through the issue of tokens which document the rights assigned to class T instrument holders and related events, and are managed in an IT platform which uses DLT (distributed ledger technology).

As proof or our interest in participating in system-wide projects, Mediobanca Premier was one of the first banks in Italy to participate in the “Spunta interbancaria” project. This project, which was run by ABI Lab and supported by technology partners such as NTT Data and SIA, now involves around 115 banking groups, including Mediobanca, and its objective is to use blockchain technology to simplify the process of cross-checking cashflows between banking institutions, in order to limit the risks and costs entailed by the business to be reduced substantially.

After this first positive experience with ABI Lab, a project was launched by Mediobanca Premier with a new-generation platform known as “FAST”, in conjunction this time with AllFundsBlockchain business lab, with the objective of generating efficiencies and reducing the time required to manage fund transfer processes (currently 45 days on average). The preparatory phase which involved analysis of the technical solution is now complete, and a detailed release plan is being defined. The new form of operation via Blockchain will run alongside the current process of fund transfers until all the players involved (brokers, banks, distributors, fund managers, etc.) have adopted DLT (Distributed Ledger Technology).

To support operations in the Capital Markets area, we have automated the investment certificate issuance processes through agoraPlatform, which uses DLT to achieve enhanced operating efficiency. The project, developed in conjunction with UK-based company agora Digital Capital Markets Ltd (“agora”), is consistent with the way in which investment certificates are becoming increasingly established within the panorama of innovative financial solutions, and a market in which Mediobanca is now one of the leading issuers, with over 300 issues per annum. agoraPlatform is the first platform in the world to use smart contracts and DLT in the issuance and lifecycle management of certificates. The platform significantly reduces the time required to produce the offering documentation for issues of investment certificates: an activity that normally requires a substantial amount of information to be repeated, and which, as such, is potentially liable to operational errors. agoraPlatform makes it possible to process the majority of this information automatically, limiting human input to the initial stages only. The platform effectively gives Mediobanca a huge competitive advantage, especially at a time when distributors are tending to favour issuers who are able to offer not only competitive prices but also an improvement in time-to-market in terms of preparing the contractual material, which is a key factor in effective allocation of investment choices.

In particular, the infrastructure developed by agora facilitates seamless interaction between the various units and divisions of the Capital Markets area (sales, structuring, trading and documentation) in a digital environment, and allows all offering documents to be drawn up and finalized automatically, including term sheets, final terms and conditions, and other ancillary documentation, with real-time synchronization of all stakeholders, internal and external, involved in the entire issuance process.

In exploring the possibilities offered by blockchain technology, we are also closely monitoring developments linked to web 3, which combines AI and blockchain technologies, and will radically alter the approach to using services online, granting users access to valuable experiences that previously would have been inconceivable. The Metaverse is a first step in this direction, and here at Mediobanca we are exploring all the opportunities offered by this immersive digital experience, and carefully analysing the new value added services that can be provided through it.

At Mediobanca, we are monitoring the developments and opportunities offered by the world of Artificial Intelligence (AI), with projects that follow a roadmap for applying the technology based on the Group’s different business requirements.

Artificial intelligence has been used to develop an improved user experience for customers, with the creation of a chatbot for Mediobanca Premier clients based on IBM Watson technology, available 24 hours a day, seven days a week, via website and mobile app, which has enabled an improvement in customer service. We have also developed two other chatbots: one for all Group staff, to answer questions on HR issues, and one for technical and individual IT issues (IT Service desk).

We have also developed a solution to support the business teams in the area of derivative product management. This is why, working in partnership with NVIDIA, the leading international graphic processor, we have developed a derivatives management calculation infrastructure. The project has been implemented with a view to streamlining the customer’s experience, enabling clients to construct their own financial products, increase their value and manage them. The success of this initiative was the result of a co-ordinated effort by various teams within the Ban, and was supported by technology components of the highest quality.

We are also working to implement AI solutions in Corporate & Investment Banking, where we feel that technology will be an important competitive driver. Significant benefits have already been achieved through the use of artificial intelligence by our product factories RAM Active Investment, our Geneva-based boutique specializing in systematic asset management (funds that use software and sophisticated algorithms to generate above-average returns), and Polus Capital Management, which uses prototype machine learning applications in fund management.

We are also launching various projects to understand the potential of Generative AI (GenAI) in the finance sector, with a view to achieving enhanced efficiency in the performance of time-consuming activities and to improving customer support by providing bespoke services.

We are also using Robotic Process Automation (RPA) solutions more extensively and with increasing success. Thes solutions serve to significantly reduce the amount of time and effort necessary in order to complete certain activities, and to free up time for staff to devote themselves to higher value added activities.

The implementation of these activities in the back office processes of Mediobanca, Mediobanca Premier and CMB Monaco has enabled significant advantages to be obtained in terms of reduction of operational risk and increased cost efficiency. We have also extended the use of RPA to certain other areas of the Group, using increasingly sophisticated cognitive automation approaches that use artificial intelligence instruments.