Our corporate governance model

Corporate governance system and bodies

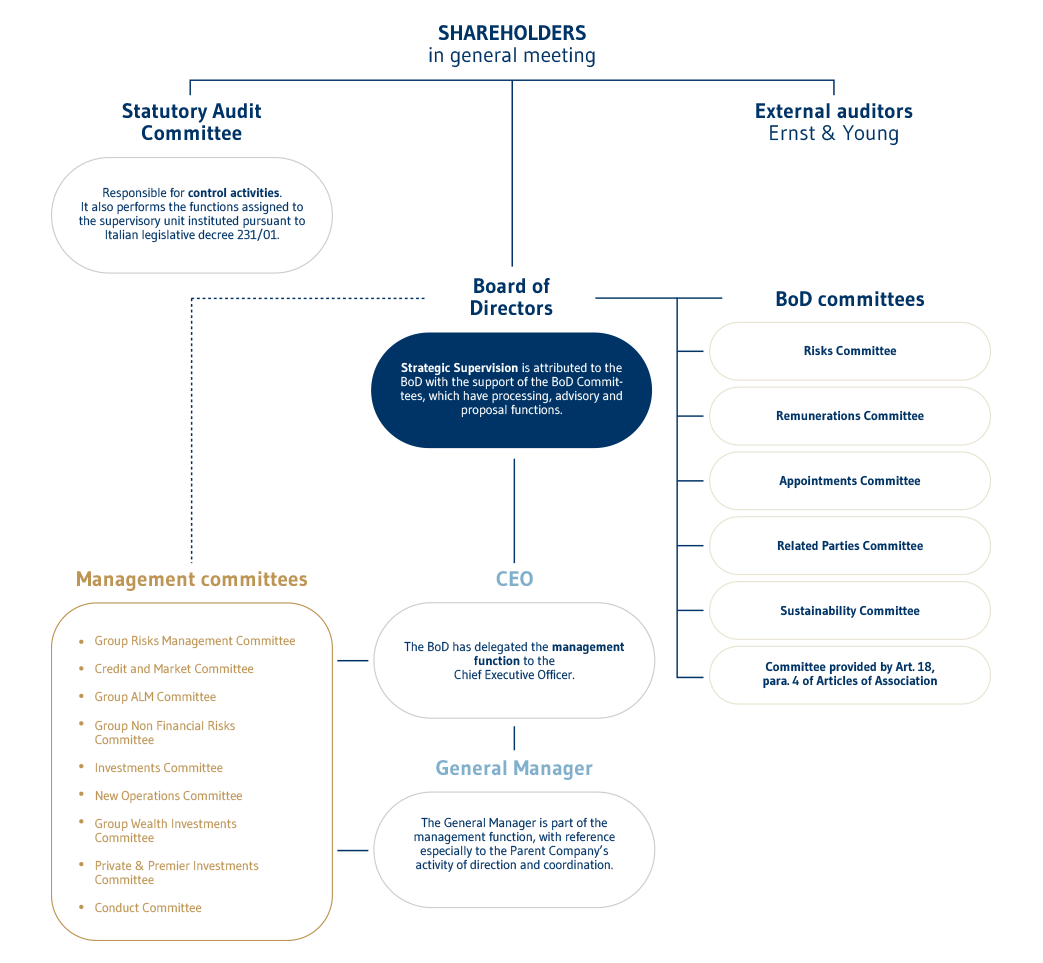

The traditional corporate governance model is based on a Board of Directors and a Statutory Audit Committee, both of which are appointed by shareholders in Annual General Meeting. Within this system, the governance arrangement we have adopted provides for a clear distinction of roles and responsibilities between the two governing bodies, as described in the Articles of Association.

- Strategic supervision is attributed to the Board of Directors appointed by shareholders in Annual General Meeting: the Board adopts resolutions regarding the strategic direction to be taken by the Bank, and verifies their implementation, and also decides on the acquisition and disposal of significant investments.

- Requests and contributions from made by the independent Directors are co-ordinated by a Lead Independent Director.

- The Chief Executive Officer is responsible for management of the company, and for implementing the strategic direction set by the Board of Directors.

- Meanwhile, the Statutory Audit Committee, also appointed by shareholders in Annual General Meeting, is responsible for control.

In accordance with the recommendations made in the Code of Conduct and in the Bank of Italy Supervisory Instructions on the subject of corporate governance, the Board of Directors has set up a total of Committees: Risks, Related Parties, Remuneration, Appointments, Sustainability, and the Committee set up pursuant to Article 18(4) of the Articles of Association.

Our Group has undergone a profound transformation process in the last fifteen years, developing from a holding company to become a specialist financial group. The changes in the business model have gone hand in hand with the changes in the ownership structure: the historical shareholders’ agreement was wound up on 31 December 2018, and a consultation agreement entered into on 20 December 2018 between various shareholders representing an aggregate 11.4% of the share capital, with no provision made for restrictions over the shares owned.

In these years we have taken steps to simplify, enhance and improve our governance, aligning ourselves with the best international practice, with the aim not only of achieving compliance with the increasingly strict regulation and the requirements of the Code of Conduct, but also of meeting the expectations of the institutional investors represented among our shareholder base increasingly effectively. The changes made to our Articles of Association in 2020 chiefly regarded certain aspects relating to the changes in our ownership structure and intended to achieve closer alignment with best international practices in the banking industry, providing for increased flexibility in the process of selecting the Chief Executive Officer and enhancing the independence requirements for non-executive Directors.

This improvement process has translated to changes in the Board of Directors: today our BoD is leaner, more strongly independent, including the presence of a Lead Independent Director, more gender diverse, and with minority interests better represented.

In view of the increasing importance of non-financial (ESG) operating issues, in 2019 the Board of Directors set up a Board Sustainability Committee, to strengthen the work of the existing management committee.

In addition to the committees required by the regulations, the Board of Directors has also set up a specific committee (referred to as the “Committee instituted pursuant to Article 18(4) of the Articles of Association”), responsible for proposals regarding appointments to the governing bodies to be submitted to shareholders at the AGM of investee companies in cases where Mediobanca’s interest is equal to at least 10% of the investee company’s share capital and over 5% of the Group’s regulatory capital.

The Group’s financial statements for the 2022-30 period are audited by EY S.p.A. The partner responsible for the engagement is Davide Lisi.