International business

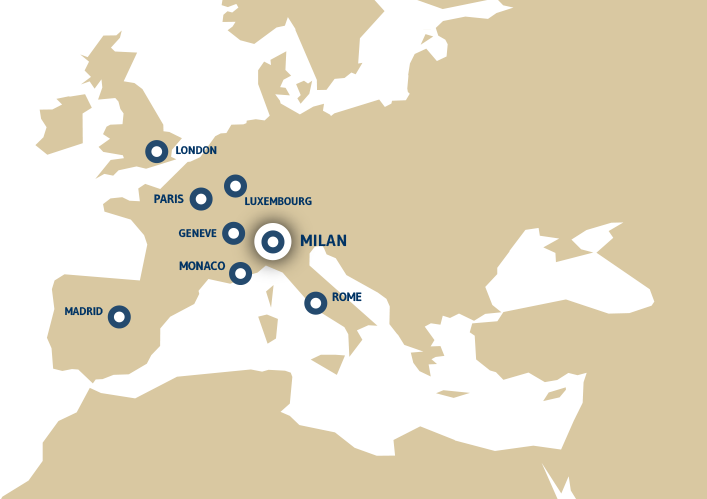

Mediobanca, the leading investment bank in Italy, has extended its investment banking operations to the rest of Europe as well in the past fifteen years. Today we are a leading player in Southern Europe, with a strong footprint in France, Spain, Germany, Switzerland and the United Kingdom.

The objectives contained in our 2023-26 Strategic Plan “One Brand-One Culture” include the creation of a broader and more diversified pan-European platform in Corporate & Investment Banking (CIB), with a higher percentage of revenues generated from non-domestic activities.

Our international strategy is distinctive for its:

- Synergic approach between sectors, products and countries, with branches and offices in Paris, New York, Madrid, London, Luxembourg and Frankfurt. The Frankfurt office, opened on 1 July 2024, has enabled us to expand our Mid-Cap platform into Germany

- Leadership in investment banking in Southern Europe, on the strength of the growth by the Madrid branch office and the long-term partnership entered into in 2019 with Messier et Associés, in which we now own a stake of more than 82%

- Leading position in the Tech/Digital segment following the acquisition of Arma Partners (see below)

- Dedicated energy transition team, recently set up, which is especially active in Italy and Spain

- London-based hub for client coverage and international investment banking activities

- Launch of CO2 trading activities and the certificates platform in Switzerland.

With Arma Partner we have become a credible player in financial advisory services for the Digital Economy

In October 2023 we completed the acquisition of Arma Partners, a London-based company specializing in the digital economy sector, which has around 70 bankers, and a vast and globally diversified customer basis.

Arma Partners is positioned as partner of choice in corporate finance for large, listed companies and private equity funds operating in innovative sectors.

The deal will enable us to play a leading role in the digital economy sector at European level.

With Messier et Associés we have strengthened our presence in France

In 2019 we entered into a long-term strategic partnership with Messier et Associés (MA), initially acquiring a 66% stake which has since risen to 82.44%. MA is one of the three leading corporate finance boutiques in France, with a wide and loyal client base, at international as well as domestic level. It employs around 40 professionals, and specializes in M&A advisory services to medium-sized/large enterprises and in financial sponsors activity. With this deal our Group has achieved a position of primary standing in France.

Our Wealth Management division has a consolidated presence in the Principality of Monaco through Group Legal Entity CMB Monaco.

In asset management, we have product factories located outside Italy, namely Polus Capital in London and RAM AI in Geneva.

In September 2024, Compass Banca launched Heylight, an integrated platform offering innovative payment and credit services. Heylight was developed from a combination of the company’s domestic BNPL solution Pagolight and the integration of HeidiPay, the recently acquired company which is a reference player in the Swiss consumer finance market. Heylight already has more than 30,000 POS (physical and e-commerce) in Italy, plus 500 commercial agreements with important distributors, luxury brands and technology operators in Switzerland. Compass will leverage the strategic Heylight platform to expand its consumer finance business based on a multi-country approach.